Regional Banks

Crunched!

We have no special insights into the likely depth or duration of the banking crisis, but the impact on credit has already been severe. That might seal the fate of the economic expansion. It’s worth noting that in 2008, the recession seemed to have “caused” the credit crunch—not the other way around.

Herd Instinct

Growth and Tech have been the flagrant winners YTD, yet the SVB crisis triggered further bifurcation: Since SVB failed, it’s been important to own only “big” Growth and “big” Technology, amplifying the multiples of monster stocks, like MSFT and AAPL. Can a major market low occur when investors are herded in a handful of the most richly-priced public companies in history?

George Bailey Goes To Silicon Valley

One of the most vivid memories of the Great Depression is the sight of nervous depositors lined up outside a bank hoping to withdraw their meager savings before the bank failed. Like a rare tropical disease that was thought to be eradicated by modern medicine, the classic bank run reappeared this month in the form of Silicon Valley Bank. At the beginning of March, the market had no particular concerns about the potential for systemic bank failures, but SVB’s sudden demise has cast a pall over the entire industry.

Financials Sector Ranks #1 In GS Scores

Impressive strength across the factor spectrum implies that the recent pop in the long-time beaten-down Financials sector should have more room to run. We highlight five attractively-rated Financials groups for investment ideas beyond the popular big-bank-concentrated Financial sector ETFs.

The Year That Was.....And The Year That Is

Many are calling 1985 a stock picker's year, but I don't see it that way. Looking at the market in terms of themes or broad sectors there were some very strong performance divergences. For the year, Regional Banks, Medical Technology and Ethical Drugs were outstanding and in the fourth quarter, big classic growth stocks and technology stocks came on strong.

Financials Remain Atop Sector Rankings

Our Financials Sector Ranking has been strengthening since August—well before the Trump Bump. The addition of Regional Banks to our SI Portfolio boosts our Financials exposure to an overweight 26% versus the S&P 500’s 15% weight. Reinsurance and Developed Diversified Banks are also among the Attractively-rated options for diversification within the sector.

Financials With Post-Election Appeal

Forces specifically driving many Financials groups include expectations for an ongoing yield rally and a steepening yield curve, tax cuts, and loosening financial regulation. While these outcomes remain largely speculation, the odds have improved and any of these developments would be a welcome change.

Financials Strengthen; Regional Banks Purchased

Financials rose in December to rank #1 among sectors for the first time since the start of the financial crisis. In-line with our quantitative disciplines, we added a new Financials group to the Select Industries Portfolio: Regional Banks.

Insurance and Regional Banks Have Strong Week

Small Biotech, Managed Health Care and Internet Retail continue to lead YTD.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations again this month, but we trimmed a few groups and added Commodity Chemicals. All group holdings currently rate Attractive. Global Industries had no changes. Emerging Electric Utilities, which we added last month, was the second best performing group in March.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations this month, and we made no significant changes to our group weights. All group holdings currently rate Attractive. Global Industries eliminated our longest tenured group, Regional Banks, which we held for two years. We added Emerging Electric Utilities, which is our first EM oriented group since June 2013.

Regional Banks – Plodding Down Recovery Road

Updating our thoughts on our group holding as it continues its recovery. We’re still bullish despite its recent slip into the top of the High Neutral zone.

Regional Banks On The Road To Recovery...Time To Buy

Analysis of Regional Bank financial health measures relative to years past, both before and after the financial crisis reveals that the group’s vital signs appear to be largely on the mend.

Financials: Initial Target Satisfied....Now What?

In our equity portfolios we have avoided much of the Financial sector’s collapse, but unfortunately suffered a hit on the Regional Bank stocks over the past two months. The group faded to Neutral in our GS Scores this month and has been deactivated.

Bottom Fishing The Regional Banks

GS Scores in April put Regional Banks in Attractive zone for the first time since October 2006. Valuations show the Regional Banks to be relatively cheap, and Insiders are buying.

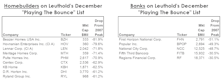

A Discount Shopping Guide To Banks And Homebuilders

With a heavily promotional holiday shopping season underway, we feel compelled to join the fray by looking at the big markdowns in U.S. homebuilding and bank stocks.

New Group Coverage…Banking On The Community

Initiated coverage of a new banking group subset in our Financial sector that focuses on small cap, community-focused banks.

Sector Musings

Notes on Regional Banks, Health Care and the “Branded Stocks”.

View from the North Country

The worst may be over for New England real estate and the prospects of another major banking crisis smashing the bank stocks have greatly diminished. Thus, in this issue, we are no longer waiting for the “other shoe to drop” and are selectively adding to our bank stock holdings.

Results of the June 14, 1984 Screen Tests

Jim Floyd has run new computer screens for the Consumer High Growth sector, Regional Bank Double Plays, The Undervalued & Unloved issues and the Growth Stock Bargain Basket.