Return

Thanksgiving Leftovers

Whatever one’s preferred leftovers from yesterday’s feast, the odds are good you’ll find them more appetizing than the slop served up by global asset markets this year. Stocks have obviously been turkeys, but all the surrounding trimmings that help diversify a portfolio have proven anything but complementary to the main course.

Factors And Sectors: A Curious Entanglement

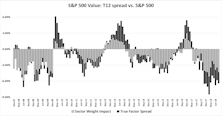

Portfolio managers who tilt toward Value or Growth stocks have long known that each style carries with it an inherent bias toward some sectors and away from others. Our recent piece, Value Style’s 100-Year Flood, highlighted the significant role that sector weights (overweight Financials and Energy, underweight Technology) played in Value’s decade-long stretch of underperformance.

Research Preview: Sector-Adjusted Factor Returns

This article summarizes our current research into the interaction between factors and sectors. We find that sector weights have a significant influence on some factor results, while the true factor impact is the key driver for others. Watch for our full report coming next week.

Full Employment And Rising Prices Aren’t Stock-Friendly

Annual Producer Price Inflation rose to 4.0% in May, a key threshold above which the S&P 500 has historically delivered essentially flat returns. But the fact that this reading occurs against a backdrop of full employment is cause for even more concern. Context is key...

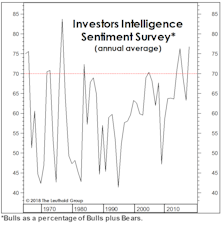

A Long-Term Take On Sentiment

We impatiently published this study two months ago instead of properly waiting for full-year numbers.

Dependence On Initial Conditions, Valuations And Forward Returns

A client inquiry led us to take a fresh look at the relationship between current valuations and subsequent stock market returns, which is a regular feature in our Benchmarks publication.

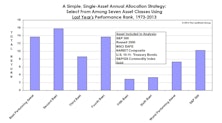

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Why It Has Been Tough To Beat The S&P 500 In 2006

This month’s “Of Special Interest” study presents a handful of factors that explain why life for active managers has been much more difficult in 2006.

View From The North Country

Managing Your Mother Lode…Your Serious Money. Ten rules written for a soon to be published book, The Book Of Investing Rules, which contains an anthology of rules from well-known investors and financial professionals.

View From The North Country

Individuals are sincere about investing appropriately, but get virtually no advise about risk. Also, putting the speed and volatility of the internet revolution in perspective.

1997 Dreams And Nightmares...Minimal Metamorphosis

Each January, this publication has presented a look back at the prior year’s best and worst industry groups and institutional stocks.

An Excellent Return Alternative to Stocks...With Much Less Risk

Bonds a good return alternative to stocks. Fed will help put the brakes on the economy while current yields seen to already discount another bump-up in rates.

Worth Noting

Steve's thoughts on borrowing to buy mutual funds, indexing and an eerie post-Halloween graphic.

Valuation Considerations

S&P 500 normalized PE and yield in top (worst) decile of 1926 to date data history. From these valuation levels 12 month total returns average a big fat zero.

View from the North Country

In terms of outstanding investment returns from U.S. markets, the last 10 years have been close to unprecedented but the next decade in this business won't be so easy. This is what our historical research and common sense tells us.

Stock Market Performance In Historical Perspective

A few months ago John Lillard, President of JMB Institutional Realty, had a great idea for us. One of John's suggestions was that we compile histograms of past stock market performance to help put the recent outstanding stock market performance in better perspective. Yes, some of our best ideas come from clients.

Inflation/Deflation and the Stock Market

Today, many are concerned about the potential negative impact of deflation and the stock market. Our work demonstrates that moderate deflation has typically not been a hostile stock market environment. However, deep deflation (5%-11%) has historically been a bad time for stocks.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)