Revenue

Small Cap Quality Check

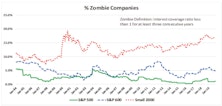

December’s Of Special Interest provided a recap of our Asset Allocation team’s view of small cap equities, suggesting that small caps had underperformed and reached a valuation discount that made them an interesting contrarian value proposition. Several clients responded with follow-up questions, wondering if the discount valuation of small caps was offset by their typically weaker business models.

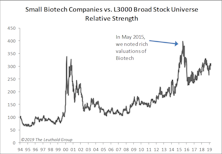

Small Cap Biotech Getting Pricey Again

In May 2015, we warned about rich valuations for small cap Biotech stocks and looked at various ways to evaluate those companies, as the majority have no approved drugs on the market, thus no revenue; therefore, valuing these companies using the conventional methodology is problematic.

Earnings Momentum

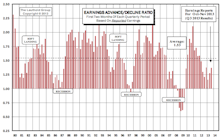

Up/Down Earnings: Q4 Results Just Below Historical Average. Median Q4 YOY Revenue Comparisons: Strength In Large Caps. Q4 Median Company Earnings Growth: Initial Results Are Impressive

Earnings Momentum

Up/Down Earnings: Q3 Ends Below Average. Median Q3 YOY Revenue Comparisons: Small And Mid Caps Continue Leading. Q3 Median Company Earnings Growth: Mid Caps Continue Leading

Earning Momentum

While the current ratio of 1.37 is relatively weak historically, it is still an improvement from the second months’ readings of Q2 (1.27) and Q1 (1.16).

Earnings Momentum - Q2 Reports Below Average But Ahead Of Q1

With all three months of Q2 earnings reports in, the 1.28 ratio is much stronger than Q1, but remains below the 1.51 historical average ratio.

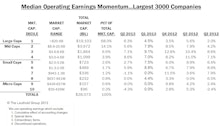

Q2 Median Company Earnings Growth Rates Vary Drastically Across Cap Size

EPS growth for Large and Mid Cap companies continues exceeding their top-line growth, but Small and Micro Cap companies saw their EPS growth rates coming in below their top-line growth rates.

Q2 Median Revenue Comparisons: Higher Growth Across All Segments

Large Cap result this month is the same as last month, but remains stronger than Q1. Smaller firms reversed course, as Mid, Small, and Micro Caps all rebounded with large sales momentum increases.

Key Observations On Q2 S&P 1500 Earnings

Year-over-year EPS growth rate for companies with Q2 reports (with about 65% in) currently stands at +4.2%, while revenue growth has come in at a better than expected +2.6%.

Q2 Median Company Earnings: Growth Rates Volatile But Positive In General

EPS growth rates are coming in higher than expected. While sales growth remains muted, the ability of companies to do more with less and maintain high operating margins is impressive. Margins are determined at the discretion of management and are thus sticky and unlikely to drop off significantly unless wage pressures resume and slack capacity around the globe is absorbed.

Q2 Median Revenue Comparisons: Higher Growth In Large And Mid Caps

Q2 relative to Q1 growth rates have improved for larger cap companies but deteriorated for the smaller firms.

Demise Of Corporate Tax Revenues? A Look At Trends Of Corporate Tax Vs. Individual

This month’s “Of Special Interest” examines Federal tax revenues from corporations versus individuals. Despite strong revenue and earnings growth, corporations paid fewer taxes this year; all of the government’s revenue increase came from individuals.

Two Quant Themes With Significant Implications For 2011

Two Quant Themes With Significant Implications For 2011. We revisit studies from the past year that focused on Revenue Growth vs. Earnings Growth, as well as Momentum vs. Value.

A Global Perspective On Investor Preference For Top-Line Growth Or Bottom-Line Growth

A look at how the market reveals its preference for the top-line growth (revenue growth) vs. the bottom-line growth (EPS growth).

Revenue Revival: The Key To Sustained Earnings Recovery

Jim Floyd examines the revenue growth of the ten broad sectors in this month’s “Of Special Interest”.

The Top Line Story: Which Groups Are Improving, Which Are Deteriorating

Believe it or not, 21 of our equity groups have not yet seen a quarterly decline in revenues. Several early cycle type groups have already experienced four quarters of declining revenues, but the good news is three groups have posted rebounds in revenues as of Q1 2009.