Risk/Return

Bridesmaid Strategy Risk/Reward

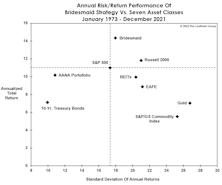

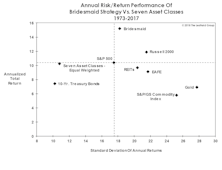

The “risk-adjusted returns” concept faded further into obscurity in 2021, with the year’s largest drawdown in the S&P 500 a mere -5.2%. But for those who still care about risk, the Bridesmaid strategy—though it often holds highly-volatile stuff like Gold, Commodities, and Small Caps—has been only about 1% more volatile than the S&P 500.

Bridesmaid Strategy Risk And Reward

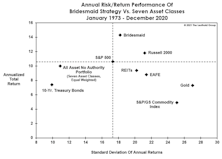

“Risk-adjusted returns” were all the rage after the Great Financial Crisis. Now that such returns are likely to become relevant again, naturally, there’s little scrutiny of them.

Bridesmaid Strategy Risk And Reward

We know that risk measurements have become passé, what with the S&P 500 having annualized at +13.6% in the last decade without a single drop of 20%. But the Bridesmaid strategy looks great relative to the available asset classes on a risk-adjusted basis.

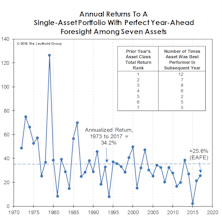

Bridesmaid Strategy: Picking The Year’s Best Asset

Here’s another way to look at the persistence of momentum across asset classes for the last 45 years.

Bridesmaid Strategy: Risk & Return

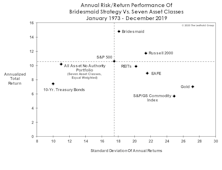

The concept of risk is hardly at the forefront of the investor psyche after the second-least volatile year in stock market history.

Bridesmaid Strategy: Return Vs. Volatility

While the consideration of risk seems almost a quaint notion as the bull market nears its eighth birthday, it’s nonetheless worth noting the Bridesmaid allocation strategy has generated a favorable return/volatility trade-off in relation to: (1) the seven candidate asset classes; and, (2) the strategy of owning an asset class with a prior-year total return rank other than #2.