Russell

Active Vs. Passive Return Drivers: Update Through December 2021

Our ongoing research into the relative performance of active vs. passive fund styles reveals that market conditions play a significant role in the active/passive return cycle. Accordingly, we identified a set of metrics that describe the market conditions we believe influence which of the two management styles is more likely to outperform. This note updates our research efforts through December 31, 2021.

Long-Term Equity Performance Coming Up Short

The bull market has pushed short-term annualized performance readings well above median levels, while the longer-term readings remain subdued. But there is a silver lining…

Small Cap Cycle Extension?

Small Caps have an historically high P/E premium of 15% vs. Large Caps. This premium could go higher, but we’d be reckless to call for a long-term extension of Small Cap leadership given this premium.

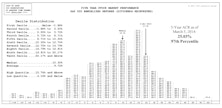

Big Cap Versus Small Cap: S&P 500 Versus Russell 2000

The following table compares the performance of the Russell 2000 Index (since its inception in 1979) with the S&P S00. Over this entire period, the Russell has outperformed the S&P in ten of the twenty years (S0% of the time), producing a slightly lower annual compound rate, 12.4%, versus 13.6% for the S&P 500.

Secondary Stocks and Secondary Stock Measures

For years we have been searching for better measures of secondary stock activity. When the new Russell 1000, 2000 and 3000 indices were developed we thought our search was over. Despite some criticism of the Russell indices, we still think this index gives the best representation of secondary stock action.

View from the North Country

Money: The Report Card of Life…An Interesting New Market Index from Frank Russell and Company…Fearless Forecast - And You Thought We Were Kiddin’

.jpg?fit=fillmax&w=222&bg=FFFFFF)