Seasonal Cycle

Yet Another Thing The Fed Has Screwed Up...

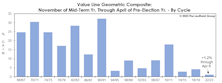

In today’s cycle, we’ve not yet observed the usual pre-election “ramp” in M2 growth. That might help explain why the traditionally hyper-bullish, six-month window beginning at the time of mid-term elections has so far been underwhelming.

A Year That Was Cursed From The Start

In January we put it bluntly: “Longer-term time cycles don’t line up for a prosperous 2022.” Not only is it a mid-term election year, but also a Shmita Year. Eight months later, the S&P 500 loss through August has exceeded 10% for only the twelfth time since 1926.

It’s That Time Of Year…

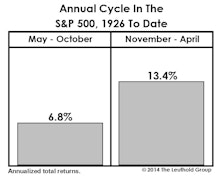

October’s nearly +7% S&P 500 surge was impressive, but came a month early—according to the traditional seasonal cycle—which turned bullish on November 1st, and will remain intact for the next six months.

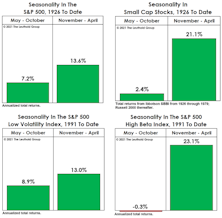

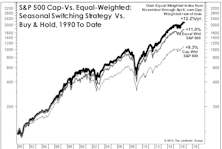

Sell *Beta* In May

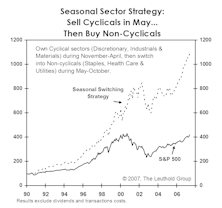

The six-month stretch beginning in May generally coincides with a narrow stock market in which non-cyclical and low volatility stocks tend to be the winners. Hence, don’t “sell” in May, but rather, tilt away from beta and away from “breadth.” These seasonal switching strategies have 70% batting averages.

Warning Crack

We wrote in October’s Green Book that “many once reliable seasonal market patterns have been out of sync in recent years.”

Cycle Collision?

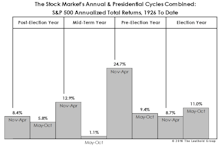

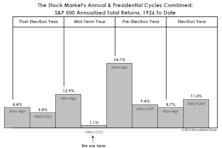

The coming months form a bearish cross-section of two of the most prominent calendar anomalies: “Sell In May,” and the Presidential Election Cycle (in which the mid-term year is statistically the weakest). Between the two, we’d have to rate the former as more powerful and statistically persistent.

How To Beat The S&P 500 With The S&P 500

While 2016 is shaping up to be one of the most difficult years ever (on a relative basis) for active equity managers, one cannot blame the usual culprit of “narrow” market participation.

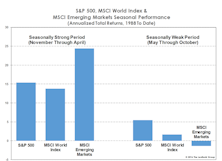

EM: The Case For Waiting...

We’ve mentioned that concerns over potential seasonal weakness in September and October seem pronounced this year, perhaps because the year has so far turned out a pleasant surprise following its horrendous start.

Sell In May: Statistical Update

If this year’s interest in the “Sell In May” phenomenon is any indication, there remains plenty of skepticism surrounding the market’s recent rebound. The good news is that the “Sell In May” play has been weakest during presidential election years.

The Worst Of The “Window” Is Upon Us

Three months ago, our “Of Special Interest” section reviewed the historically pronounced effect of the well-known “Sell In May” phenomenon during mid-term years of the presidential election cycle.

Two Market Anomalies Intact: A Quantitative Review

We are entering the most bearish window among the potential combinations of the Presidential Election Cycle and the Annual Cycle.

Small Cap Stocks: Hard To Make The Numbers Work…

Leuthold’s Doug Ramsey takes an in depth look at historical Small and Large Cap cycles and offers insight as to where we stand now and what can be expected going forward.

Selling In May: A Market Maxim That Won’t Go Away!

This month’s “Of Special Interest” takes a stab at debunking the “Sell In May And Go Away” anomaly. Instead, we have come to respect this annual strategy.

Good News Is Here… Now What?

Climbing the bull market stairs. Our initial upside price target for the S&P 500 is 1300 to 1350. This is based on normalized P/E ratios moving to prior bull market average peak levels, as well as on past market peaks.

October Panics: Plenty Of Facts, But No Explanations

Mark Twain observed more than a century ago that October represented a “peculiarly dangerous” month to speculate in stocks—with the other dangerous times including the remaining 11 months on the calendar.

That Time Of Year For Tech??

We have found that technology has the strongest seasonal tendency of any sector during the market’s “bullish” seasonal period of November through April.

Yearning For Those Summer Doldrums...

In the past, Wall Street activity slowed in August as professionals headed for the beach. However, the “Hyper-connected Era” has changed all that, as evidenced by higher market volatility in recent years during July and August.

Major Trend Goes Positive....No Need To "Sell In May"

The statistical tendencies of seasonal patterns just haven’t proved persistent (or logical) enough for us to build them into our Major Trend Index. Can it be a bear market if the major indices do not decline more than 20%? Putting a nail in the coffin of the decoupling theorists.

View From The North Country

Steve Leuthold discusses the rationale for using “normalized” earnings versus 12-month earnings and how it now makes little sense to sell in May and go away…..unless you need a long vacation.

Sell In May: Reformulated For The Fully-Invested

While the “Sell in May” market phenomenon has become part of Wall Street lore, the sector implications of this seasonal pattern are less well-known.

View From The North Country

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here. Nor is it time to be buying oil stocks.

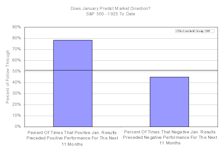

Is January Performance Predictive?

A look at the January barometer, indicates there is not much evidence that a weak January market portends weak performance in the remainder of the year.

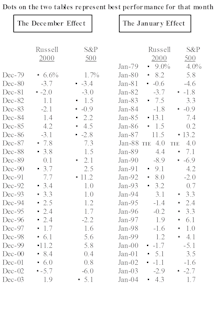

January Effect: Now Tends To Arrive In December

The January effect still lives…..it just comes a month earlier in December.

Following The Script?

Yes September is most frequent month to produce declines, but average loss has been only a paltry 1.3%. Also, Septembers following bear market lows (like this year) actually produced strong performance.

“Sell In May And Go Away”

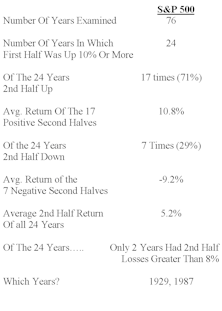

It looks like a strong first half can still lead to a good second half, unless the first half was really good.

Playing the Bounce

It's that time of year again. The Leuthold Group is embarking on its annual "Playing the Bounce" bottom fishing expedition.

Worth Noting

Tony Tabell (Delafield, Harvey, Tabell Inc.) often has interesting statistical studies in his weekly market letter. By Tony’s calculations, August historically has been the second best month of the year for the stock market.