Secondary Offerings

“Change In Equity Shares Outstanding Factor” Surprises In 2020

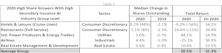

Historically, companies that have grown their equity share base over the previous year are apt to underperform the broad market in the ensuing months; those that had reduced shares outstanding tend to outperform. However, the opposite happened over the course of the last year. Here we explore the underlying details to see what contributed to this result.

A Second Opinion On Secondaries… Increased Supply Can Be Bullish

After an uneventful start in 2009, deal flow for equity financings has jumped to life in recent weeks.

Morose On Main Street… So Why Isn’t The Smart Money Worried?

Consumer confidence levels have sunk to five year lows. Could this be a bullish omen for the markets?

Market Sentiment: Currently A Mixed Bag

An in depth discussion of market sentiment...At present, it is a real mixed bag, there is no clear cut consensus.

Focus On Equity Supply

This year’s equity offerings volume, as measured by common shares in IPO and secondary financings, finished the year well below the levels of 2000.

Supply/Demand Considerations

Positive net cash flows into U.S. focus mutual funds are no longer overwhelming new equity offerings. But no investor panic yet.

The Supply/Demand Standoff

The public continues to roll the money into mutual funds and Wall Street continues to roll out the new equity offerings. The Supply/Demand standoff more or less continued in April.