Share Buyback

Cycles And Taxes And GICS, Oh My!

Analyzing quarterly financial results and developing insights about upcoming periods is always difficult, but the first quarter of 2018 was unusually complicated.

Does Returning Cash Crowd Out Capex?

Companies are returning cash to investors at a level never before seen. Does the historically high level of cash being returned to shareholders crowd out the use of cash elsewhere? One wide-spread concern is that by shelling out cash through dividends and share buybacks, companies are spending less on capital expenditures. Is that a real concern?

Can Companies Sustain Cash Payouts?

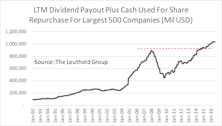

Companies are returning cash to investors at a level never before seen. Counting dividend payouts and outstanding share repurchases, the amount of cash returned back to investors crossed the $1 trillion mark for the first time in January 2016 (based on trailing twelve-months’ total for the largest 500 companies, Chart 1).

Are We Floating In Another Share Buyback Bubble?

Share repurchase activity among U.S. corporations is garnering a lot of negative attention as aggregate dollars spent on share buybacks are nearing the all-time highs last seen leading up to the financial crisis. We take a closer look at the recent activity to see if we are in for a repeat.

Corporate Share Repurchases Now At Record Levels...Five Reasons Why They Are Expected To Slow

Share repurchases have been a major driver in the extension of the bull market, but this month’s “Of Special Interest” outlines several factors which are likely to contribute to a deceleration in corporate repurchase activity over the next several quarters.

How Significant Are Buybacks?...A Summary

While stock is being repurchased through the front door, additional shares are going out the back door for stock options, incentive compensation, and acquisitions.

Worth Noting

T-bonds are now clearly in the lead in the 1995 Performance Derby. Do dividend yields matter? Polling the pros in Baltimore and Boston.

Worth Noting

“Polling the pros” in April, adjusting stock market dividend yields for “buybacks”, mutual fund flows, looking beneath the Finished Goods PPI, and the possibility of rising inflation and interest rates.