Shmita

Delayed Reckoning?

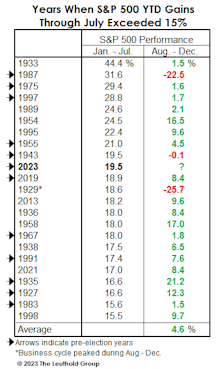

The month of October gets all the “love,” but since 1990, August has been the cruelest month for stocks. We point this out because calendar patterns lately seem to explain this market better than just about anything else. In 2022, big losses in stocks and bonds arrived right on schedule—during a time of Jewish sabbatical (the Shmita Year).

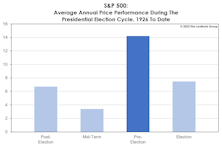

2023 Time Cycles: Two Outta Three Ain’t Bad

2022 was a nasty year for the stock market, but a wonderful one for market numerologists. This year is a different story. Two of the three calendar patterns are bullish, including the one in which we put the most stock (pun intended): The Presidential Election Cycle.

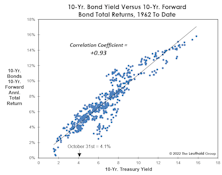

Bonds: Not A Four-Letter Word

The bond market bubble has popped, and forward-looking Treasury returns are no longer a disaster. We aren’t suggesting one pile into them with yields near 4% and inflation around 8%, but we think they have suffered a much more substantial de-rating than large-cap stocks.

A 2022 Trifecta?

Our Major Trend Index has four factor categories, and three of them (Valuation, Cyclical, Technical) remain negative. Yes, the bearish “trifecta.” If that sounds like a reprint of one of our Monday MTI memos, bear with us (pun intended). We thought the MTI—with over 125 inputs—was pretty exhaustive. It turns out that it’s lacking entire categories pertinent to stock market action:

Seasonal Nightmare Ending?

We’ve reminded dejected readers throughout 2022 that this year was statistically “cursed” from the onset. It’s a year ending in “2” and a Shmita year on the Jewish calendar, both of which have been associated with far below average stock market returns. More importantly, it’s a midterm election year, traditionally the weakest of the four-year cycle.

A Year That Was Cursed From The Start

In January we put it bluntly: “Longer-term time cycles don’t line up for a prosperous 2022.” Not only is it a mid-term election year, but also a Shmita Year. Eight months later, the S&P 500 loss through August has exceeded 10% for only the twelfth time since 1926.

Time Cycles Got It Right; What Do They Say Now?

The enormity of the preceding mania and its vicious unwind have us believing the current bear could unfold over a much lengthier time than is typical. But a combo of time cycles suggests a major low is due any time.

Time Cycles Say There’ll Be Better Times Than 2022

Numerologists will be disappointed to learn that longer-term time cycles don’t line up for a prosperous 2022 for stocks. However, the historical “hit rates” aren’t high enough to justify running for cover if you have no other fundamental stock-market worries.

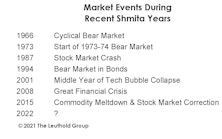

A Religious Calendar Calls For A 2022 (Market) Sabbatical

With the most speculative year in U.S. stock market history drawing to a close, we could probably all use a rest. How about a rest that lasts 12 months?

The year 2022 on the Jewish calendar is a Shmita year—historically considered to be a year of rest, or sabbatical, following six years of work. Unfortunately, markets have frequently taken this suggestion quite literally! There’s been a major financial disruption in seven of the eight Shmita years dating back to 1966: