Signal

2020 Post-Mortem

This summer marks the first anniversary, not of the COVID-19 stock-market low, itself, but of the much belated “confirmation” of that low.

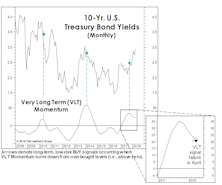

A “Busted” Bond BUY Signal

Last October our VLT algorithm recorded a bond BUY signal—one that we said, at the time, conflicted with our outlook.

Risk Aversion Index Turns Higher, New “Higher Risk” Signal

We are turning defensive within fixed income and recommend moving up the quality scale.

Risk Aversion Index Edges Lower, Stays On Its “Lower Risk” Signal

We are in the seasonally favorable part of the year and we continue favoring high-grade credits within fixed income.

Risk Aversion Index Falls Further, Stays On Its “Lower Risk” Signal

We seem to be in a “Goldilocks” period, where economic numbers are not bad enough to re-ignite recession fears but are just weak enough to push the taper farther off.

RAI Falls, But Stays On “Higher Risk” Signal—Remain Cautious

The RAI fell in August and stayed on a “High Risk” signal. We remain cautious and recommend higher quality within fixed income.

RAI Fell, But Stayed On “Higher Risk” Signal—Remain Cautious

The RAI fell in July and stayed on a “High Risk” signal. We remain cautious and recommend higher quality within fixed income.

Deciphering The Real Message In The Employment Figures

It’s a big mistake to react to the headline reports of employment, and an even bigger mistake to make investment decisions based on them.

The Rally Is For Real (And For Earl)

Despite the recent rally, the best two month move since 1933, investors migrating back to bearish camp. This is the best defined “wall of worry” we have seen in over a decade, and one that will provide more fuel for what we believe is a cyclical bull market.

The VIX: Another View On Buy Signals

There does appear to be some validity to using relative highs on the VIX as short term Buy indicators.

Sorry About That…

Several clients have requested information as to the components of the Early Warning Index. We have no secrets....well, not very many, so here are the tools we use to help in identifying intermediate stock market tops.