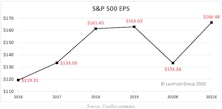

S&P 500 EPS

Earnings Expectations: The Bear’s Other Shoe

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.

2021 Earnings: How Do We Get There?

According to FactSet estimates, S&P 500 earnings for 2020 are anticipated to come in near $133 per share, a drop of 18% from 2019 results. Given the widespread business disruptions and closures caused by the pandemic, one might have expected this year’s results to be much weaker.