S&P 600

Small Caps Getting Cheaper By The Day

It was September 2020 when we suggested that a new multi-year phase of Small-Cap-stock leadership had begun. Almost immediately, the Russell 2000 reversed a big chunk of the prior decade’s underperformance. Unfortunately, that was the extent of the run.

Easy Money? Not In Small Caps

One might have predicted that big beneficiaries of war-time-style levels of federal spending, financed by money printing, would be Small Cap stocks. And from March 2020 until March 2021, they were. But the larger picture is sobering.

Profiting From Mighty Mites

One of the signature traits of the U.S. small cap market is the prevalence of money losing companies. A recent tally indicated that prior to Covid, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

A Small Cap Strategy Session

Leuthold’s research team has recently flagged a number of items that suggest it may be time to consider small cap stocks. This asset class has been showing signs of life and the decision to overweight small caps is starting to seem relevant – and perhaps nicely profitable - again.

A New Take On Small Cap Valuations

For valuation work, we’ve traditionally favored the 1,200 company Leuthold Small Cap universe over the S&P SmallCap 600 because we get almost a full additional decade of perspective. But figures for the latter shed extra light on just how significant the revaluation in Small Caps has been.

Try This On For Size

Today’s market is barbelled regarding company size, with the mega-cap Tech stocks and the S&P 600 Small Cap index both outperforming the middle of the S&P 500.

Small Caps' Stumble Is A Global Affair

Small caps have trailed the S&P 500 performance by 12-15% since peaking out on a relative basis in the spring of 2006. International small caps have broken down even more decisively on a relative basis.

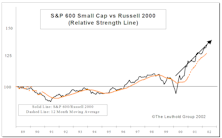

Comparing Small Cap Performance Measures

Small Cap indices performance divergence. Why has the S&P 600 significantly outperformed the Russell 2000 the past two years?