S&P

Y2K 2.0?

Cap-weighted valuations for the S&P 500 and S&P Industrials are homing in on the all-time records seen in the first quarter of 2000. We’ll confess that after those valuations collapsed in the years that followed, we thought we’d never see them again in our lifetime—let alone a mere generation later.

The Trump Trade, Two Years In

Donald Trump is thought to have been born with a silver spoon in his mouth, and the economic circumstances prevailing at his inauguration two years ago might have further perpetuated that view. The U.S. economy had already been in recovery mode for 7 1/2 years, and the bull market in U.S. stocks was about to celebrate its eighth birthday.

Stock Market Breadth: So Good We’re Suspicious

Market breadth measures have been so strong since the February low that we wonder whether something might be wrong with them.

The Economy And Earnings

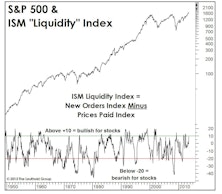

The YTD surge of 19% in the S&P 500 should ensure a stronger second half economy, and the big five-point jump in the latest Purchasing Managers Survey (ISM) might be the first evidence of this.

S&P's "Core" Earnings Methodology Losing Support?

We applauded S&P for developing a standardized approach which adjusts GAAP earnings for several problem accounting areas and produces a better representation of “True” earnings.

View from the North Country

Where Do We Go For Good Investment Returns Now?... Polling The Pro's For Our Client's Current Stock Market Attitudes...Taking Another Look At The New S&P Midcap Index

.jpg?fit=fillmax&w=222&bg=FFFFFF)