SPACs

The 2021 Speculative Mania And Its Aftermath

One of the societal benefits of recessions and bear markets is that they serve to correct the unhealthy excesses that build up in overheated economic booms and overly enthusiastic bull markets. As market historians, we believe it is instructive to look back at cycles of excesses and their corrections to learn how such patterns evolve and, quite often, repeat themselves.

“Memes” Need Money Growth...

The extra months of QE “auto-pilot” failed to support some of the themes we’d have thought were the most likely to benefit from it—including IPOs, SPACs, Bitcoin, and the sky-high growers favored by the ARK Innovation ETF. Instead, the smart play with each of these assets was to ignore the ever-expanding Fed balance sheet and sell in February.

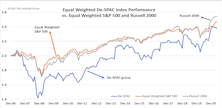

After The SPAC: De-SPAC Performance

The ultimate measure of a SPAC sponsor’s success is stock performance post merger: De-SPAC results. We analyze historical returns of De-SPACs that had initial market caps greater than $200 million.

SPACs: Fashion Or Fad?

Special Purpose Acquisition Companies (SPACs) have become increasingly popular of late. We ask a seemingly simple question: “How do companies fare following a SPAC merger?”