Speculation

Speculating In “The Nebs”

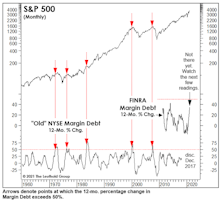

One measure of a bubbly bull market is the degree of speculative fervor embedded in the prices of companies with nebulous, indeterminate, or even nonexistent intrinsic values. Since the bear market low in March 2020, speculative manias have evolved in a menagerie of asset classes including Innovators & Disruptors, SPACs, meme stocks, crypto currencies, and NFTs. Based on the breadth of valuation extremes across numerous and diverse assets, this bull market may rank second to none.

“Peak Insanity” Is Behind Us

We think 2021 has earned its place in the books as the wildest and most speculative year in U.S. stock-market history, eclipsing even 1929 and 1999. That doesn’t mean 2022 will bring a panic or a crash, maybe just a degree of sobriety.

A Sign It Could Get “Even Sillier”

The January moves in heavily shorted Micro Caps were more bizarre than anything we saw during the wildest days of the Tech bubble. Despite these signs of rampant stock speculation by the retail crowd, we still wouldn’t characterize today’s sentiment backdrop as frenzied as the peak levels of 1999-2000.