Style Factors

Active Managers Embrace The Bear

The fourth quarter of 2022 saw broadly positive equity-market performance with the S&P 500 returning +7.6%, the Russell 1000 Mid Cap Index at +7.2%, and the Russell 2000 Small Cap Index gaining 6.2%. Strong returns usually present a headwind for active managers, but the fourth quarter proved productive for actively managed funds.

Is Value Still A Value?

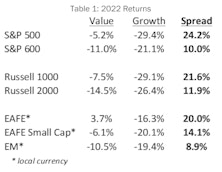

Deflating valuations in the Technology and Innovation space produced ghastly results for growth investors in 2022, with the S&P 500 Growth index experiencing an agonizing 29.4% loss. Meanwhile, last year’s bear market was no more than a mild irritation for value investors as the S&P 500 Value index lost just 5.2%. The collapse in exuberantly priced growth stocks produced a 24.2% return spread between the value and growth styles, which goes into the record books as the second biggest annual win for value since 1975.

Fair Winds For Active Managers

The defining characteristic of last year’s bear market was the collapsing valuations of speculative growth stocks. A mania for themes such as cloud computing and disruptive innovation during 2016-2021 drove those names to fantastical valuations and bestowed market capitalizations of tens- and even hundreds of billions of dollars on such companies, many of which had yet to turn a profit.

Research Preview: An Epic Comeback

Style rotation powered S&P 500 Value to a 24.2% advantage vs. Growth, while DM large-cap Value earned a 20% return spread against Growth. Small-cap spreads favoring Value were also in the double-digits, but narrower because small-cap Growth wasn’t exposed to the collapse of mega-cap Tech.

Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

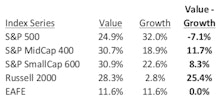

The Mysterious Affair of Style Returns

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

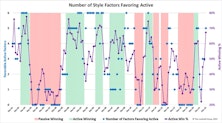

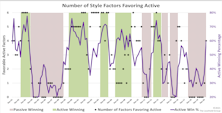

Active Vs. Passive Return Drivers: Update Through December 2021

Our ongoing research into the relative performance of active vs. passive fund styles reveals that market conditions play a significant role in the active/passive return cycle. Accordingly, we identified a set of metrics that describe the market conditions we believe influence which of the two management styles is more likely to outperform. This note updates our research efforts through December 31, 2021.

Research Preview: Is “Manager Skill” Cyclical?

The active-passive performance derby is cyclical, determined not by the ebb and flow of portfolio managers’ brilliance but, rather, by market conditions and the slippage that arises from imperfectly comparing funds and benchmarks.

The “Pfizer Factor Flip” And Fund Flows

Pfizer’s November 9th announcement of an effective COVID-19 vaccine triggered the most extensive one-day rotation in style factors we have ever seen. Investors flipped from Large Growth—the market’s dominating style over the past few years—and found new friends in Value and Small Cap. This rotation continued through November, to the point that Value and Small Cap each had their best single-month return in 30 years.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)