Style Rotation

Carbuncles, Diamonds, and Tears

High growth rates, innovation, and disruption are defining traits of the companies that have powered the market to recent highs, and the ARK Innovators Fund (ARKK) is an example of today’s enthusiasm for visionary growth stocks. Recent returns and growth in AUM have been nothing short of spectacular, and ARKK has become symbolic of today’s style of new-era growth investing.

The “Pfizer Factor Flip” And Fund Flows

Pfizer’s November 9th announcement of an effective COVID-19 vaccine triggered the most extensive one-day rotation in style factors we have ever seen. Investors flipped from Large Growth—the market’s dominating style over the past few years—and found new friends in Value and Small Cap. This rotation continued through November, to the point that Value and Small Cap each had their best single-month return in 30 years.

Style Rotation: Anything But Growth

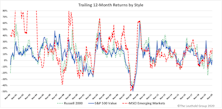

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)