Styles

Masquerade Party

Style investors recently witnessed a rare event when, on February 13th, the P/E ratio of the S&P 500 Growth Index fell below that of the S&P 500 Value Index. At first glance, it is tempting to attribute this valuation flip-flop to the 2022 bear market, which saw Value outperform Growth by a whopping 24.2%. However, the bear-induced collapse of Growth stock prices in 2022 only served to return the P/E spread to a level just below its historical median of 5.1, meaning that the final move toward parity was caused by a force outside the market itself. That “something else” was the S&P 500 style reconstitution that occurs annually on the third Friday of December.

Is Value Still A Value?

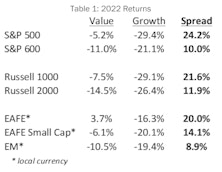

Deflating valuations in the Technology and Innovation space produced ghastly results for growth investors in 2022, with the S&P 500 Growth index experiencing an agonizing 29.4% loss. Meanwhile, last year’s bear market was no more than a mild irritation for value investors as the S&P 500 Value index lost just 5.2%. The collapse in exuberantly priced growth stocks produced a 24.2% return spread between the value and growth styles, which goes into the record books as the second biggest annual win for value since 1975.

Research Preview: An Epic Comeback

Style rotation powered S&P 500 Value to a 24.2% advantage vs. Growth, while DM large-cap Value earned a 20% return spread against Growth. Small-cap spreads favoring Value were also in the double-digits, but narrower because small-cap Growth wasn’t exposed to the collapse of mega-cap Tech.

The Mysterious Affair of Style Returns

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

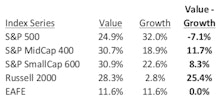

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

Research Preview: Style Swings In 2021

Despite elevated uncertainty over pandemic developments and expected policy tightening, and in the face of aggressive valuations, the S&P 500 still managed to gain a delightful +28.7% in 2021. Even more noteworthy, in our opinion, is that this advance came with nary a single correction of more than 10%.

Can Mo Outrun A Bear?

Hiker #1: Can you run faster than that hungry bear looking at us?

Hiker #2: I don’t need to run faster than the bear, I just need to run faster than you.

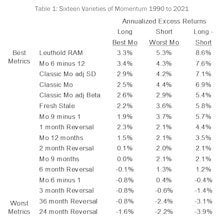

The Momentum style of investing has a long history of generating excess returns, and ranks near the top of the list of essential smart beta factors. However, Momentum also has a dark side; it is prone to severe drawdowns whenever the market makes a significant reversal.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

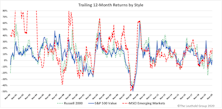

Style Rotation: Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

2021 Earnings: How Do We Get There?

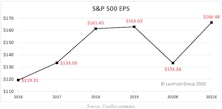

According to FactSet estimates, S&P 500 earnings for 2020 are anticipated to come in near $133 per share, a drop of 18% from 2019 results. Given the widespread business disruptions and closures caused by the pandemic, one might have expected this year’s results to be much weaker.

Growth Wherever You Find It

Growth investing is in the midst of a spectacular run this year, extending its decade-long dominance over the Value style. Chart 1 depicts the Growth / Value relationship over the last 25 years through July 31st, with key turning points marked by vertical lines.

Research Preview: Growth, Pure And Simple

Growth investing is in the midst of a record run this year, extending its decade-long dominance over the Value style.

Leadership Rotation And Bear Markets

Bear markets are the financial system’s version of the changing seasons—a cycle we “enjoy” to extremes here in Minnesota.

Factor Failure: Don’t Blame FANMAG

Our recent commentary “1” For The Record Books noted that just one of seven S&P smart beta factors was able to outperform the S&P 500 last year, even though each style basket limits its holdings to constituents of the parent index.

“1” For The Record Books

Dark energy makes up 68% of the universe, yet astrophysicists are having a devil of a time explaining what it is, why it is, or how it works. Quant investors are facing their own dark-energy mystery in understanding style returns of 2019.

Box Jumpers Beware!

Style rotation! Regime change! Market action of the first two weeks of September coaxed the few remaining Small Cap Value managers off ledges from New York to San Francisco.

Portfolio Positioning: Deciding Not To Decide

One portfolio strategy that attracts our interest is a barbell between Growth or Quality on the bullish side, paired with a Low or Minimum Volatility sleeve for the bearish side. This approach deals with today’s uncertainties by essentially “deciding not to decide.”

Styles And Factors DeFANGed

Social media, mobile computing, and digital life-in-the-cloud were the dominant storylines for U.S. stocks over the last five years—reaching the apex of popularity following the early-2016 market low.

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)