Tax Rates

So Long Tax Cuts… We Hardly Knew Ye

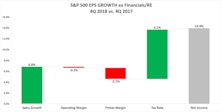

Our earnings waterfall analysis for the fourth quarter tells a story consistent with the entirety of 2018: earnings growth was fantastic, boosted by the twin drivers of strong sales growth and a lower corporate tax rate. Chart 1 spotlights the quarter’s tally, which produced a healthy sales growth number despite some economic weakening.

Impact Of Lower Corporate Tax Rate

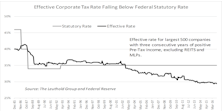

A stock market wild card in 2017 is the potential for a significant reduction in the corporate tax rate. President-elect Trump’s desire to lower corporate taxes, if implemented, would have multifaceted impacts on businesses.

Tax Rates And The Good Old Days

Top marginal tax rate of 6%...applied only to income in excess of $500,000? It was a reality in 1913!

Stock Market Reactions In Rising Tax Environment

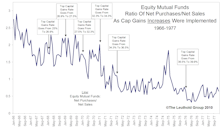

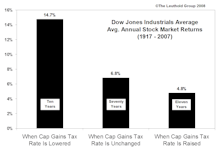

Taxes are slated to go up as Bush tax cuts expire. History shows that selling increases in anticipation of higher capital gains taxes. Stock performance also does better in anticipation of lower tax environments than higher.

Changes In The Capital Gains Tax Rate Vs. Stock Market Performance

Prospects for increase to capital gains tax caused us to examine the historical impact such changes have on stock market performance, 1917 to date. The record is not very encouraging.

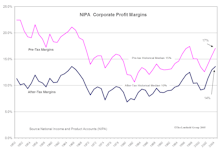

A Closer Look At Profit Margins

No matter how you cut it, we don’t expect to see much in the way of margin expansion. Further earnings growth will have to come from top line sales growth.

View From The North Country

Stage is set for market’s next advance, breaking out of its two month consolidation.

View From The North Country

Deficit Track” March data encouraging, but…...considering the tax cuts already on the books, combined with a bulge in spending, a fiscal 2003 deficit of $400 billion is in prospect.

View From the North Country

The Economic Surprise And Inflation, The Feds Overheating Economy And Inflation Fears Are Justified and “Contract With America”: The Danger Is Big Tax Cuts But Minimal Spending Cuts

View From the North Country

A reader's case against higher gasoline taxes, followed by my case for consumption taxes and a membership pitch for The Concord Coalition. Did you watch the 56 commercial spots during the Super Bowl? Do you recall what these advertising works of art were selling?

View from the North Country

Maybe it's a Minnesota year - the Twins win the World Series and Northwest Airlines leads the pack terms of customer complaints! Also, tracking the impact of Black October around the world.

The Historical Stock Market Impact of Corporate Tax Rate Changes

Historically, have tax cuts been a stock market positive? Have tax increases been a negative? What impact do changes in the tax rate have on prevailing market P/E multiples? The answers to these questions may surprise some of our readers.