Technicals

A Morsel For The Bulls

The MTI’s Technical category is still decisively negative at -3, but some of its shorter-term “counter-trend” components look intriguing for the first time in 2022’s entire decline.

Flesh Wounds, Or Something Deeper?

At the August 5th, S&P 500 bull-market high, seven of our eight bellwethers had failed to make a “confirming” high during the prior month of trading—up from six non-confirmations a month ago. “The dog that didn’t bark” (yet) is the S&P 500 Equal Weighted Index.

Musings On A Manic Market

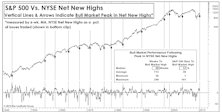

Officially, those quick to pronounce the move off March lows as a new bull market have been proven correct with new S&P 500 all-time highs. Fundamentally, though, there’s enormous risk in Large Cap valuations, regardless of where one believes we are in the economic cycle.

A Tough Tape To Read

Over the nearly two years since the stock market’s “momentum” peak in January 2018, the S&P 500 has gained less than 9%, while the Value Line Arithmetic Composite is unchanged. Mid Caps and Small Caps have made no upside progress during this period and most foreign markets are down.

“Averages” Conceal Plight Of The Average Stock

September’s small S&P 500 loss of less than 2% disguised a significant breakdown in the “average stock.” In fact, the S&P 500 has been tougher to beat than at any time since the Tech Bubble.

Breaking Bad

While we’ve noted that damage to any capitalization-weighted stock market measure has so far been limited, three of the five major indexes shown in this chart have nonetheless broken below the major trendlines drawn off their 2009 bear market lows.

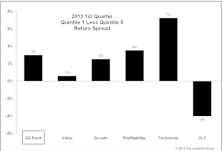

Q1 Review of Group Selection (GS) Scores

After a recent rough patch due to a multitude of factors (macro driven markets, high correlations, etc.), our domestic Group Selection (GS) Scores started seeing more consistent performance during the fall of 2012. This continued through the first quarter of this year, with the Attractive to Unattractive return spread at +3.0% year-to-date.

The 1974-1982 Template For Recovery

Current market recovery continues to track the post 1974 bear market recovery quite closely.

Bull Market Milestones: How the Current Bull Stacks Up to Past Cycles

This month’s “Of Special Interest” examines the characteristics of past bull market recoveries. Using a variety of historical comparisons, the current recovery is put into some perspective. The majority of these comparisons seem to indicate the current recovery still has a ways to go.

Using A Few Bear Arguments To Make A Bullish Case

Doug Ramsey utilizes several bear market arguments to build a bullish case. Rising Interest Rates, Overbought Market, Low Volatility, and Low Trading Volumes, can all be looked upon in a BULLISH light.

Positive Technical Trends

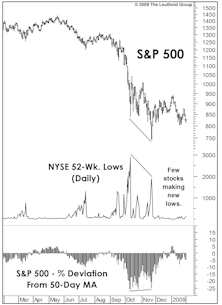

While there is plenty to worry about, some important technical trends still suggest that November 20, 2008 stands a good chance of being the final low of this bear market.

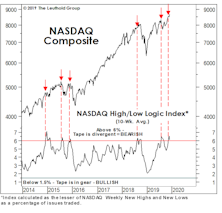

Technical Comment: Momentum “Divergences” Are Now In Place

The November leg down in stocks was brutal. However, from a technical perspective, the decline was accompanied by the kind of “positive divergences” that typically appear at major lows.

Steve The Technician

Last month, we had a request for technical readings on the major market indices. Being a long time card carrying member of the Market Technicians Association, I decided I should oblige.

October: The Month Of Market Train Wrecks

Steve thinks too many people are looking for an Octber train wreck for it to happen, maybe in November. Market currently very short term oversold.

Major Stock Market Positives and Negatives

Steve’s personal judgements and opinions incorporating observations, experience and gut feelings, going beyond the quantitative aspects of the Major Trend Index disciplines.

Should We Believe It This Time?

On June 22, clients received an Interim Memo noting that our composite Major Trend Index had slipped to Negative status. The subsequent calculation lost a few more points and remains marginally negative.

Coming: The Golden Years for Stock Market Timing

On the evening of May 14th, Steve Leuthold was the keynote speaker at the 17th annual Market Technicians Association Seminar in Naples, Florida. What follows is a slightly edited version of his speech and the charts and tables used in a workshop on the following day.

Integrating Fundamental and Technical Analysis

Steve Leuthold’s December 7th speech at a joint seminar sponsored by the New York Society of Security Analysts and the Market Technicians Association. Who says oil and water don’t mix?