Upside

The New FOMO

“Bull markets climb a wall of worry,” the old saying goes. We’ve heard that piece of wisdom (or imagined we heard it) every week since early summer. But we doubt it was meant to apply to today, when the paralyzing fear is not of potential loss, but of foregone upside (i.e., fear of missing out, or FOMO).

Estimating The Upside: Another Angle

A look at the potential upside for the median S&P 500 stock, based on the theory that each of four valuation ratios reaches its individual all-time high set during the last phase of the 1990s’ market mania.

Bubble Or Not?

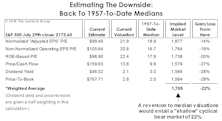

To revisit the all-time valuation peak of March 2000, the S&P 500 would have to reach 3455 (not a forecast!). A reversion to 1957-to-date median valuations implies an S&P 500 loss of 22%. That’s a serious loss, but hardly on the order of a “busted bubble.”