Valuation Gap

A Small-Cap Theory Of Relativity?

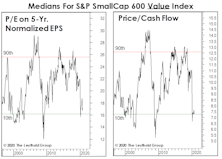

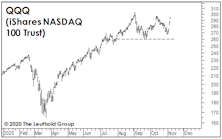

Small Cap median valuations are among the highest in our 40-year database, but they are bottom quintile versus the nose-bleed level of the median Large Cap. If this Small Cap leadership cycle only matches the shortest one on record, it will last another three years. Based on the valuation gap, that guess seems conservative.

Small Value Or Small Growth? Yes!

If there’s an emerging bubble in Growth stock investing, it certainly doesn’t apply to Small Caps. The “usual” premium for Growth over Value within the Small Cap space is nonexistent—both segments look historically cheap.

Don’t Overplay The Election

The lack of a “Blue Wave” doesn’t undermine our belief that a big stock market rotation is underway. The valuation gap between Large Cap Growth and other U.S. (and foreign) market segments is so large that it’s become unsustainable.