Valuation

Are You Better Off Than You Were Forty Years Ago?

Old timers will recognize our title as a twist on Ronald Reagan’s clincher in the final 1980 presidential debate with Jimmy Carter.

We recalled Reagan’s line while preparing for today’s 40th anniversary of the great 1982 secular stock-market low. Investors in the S&P 500 have earned an annualized total return of +12.4% since that trough, about two percentage points above the long-term average.

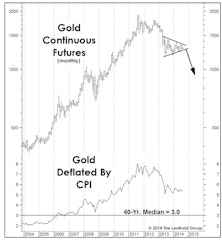

How To Value Gold

July’s surge drove the yellow metal to the brink of its overvaluation threshold, where only 150 ounces of gold are required to buy the median-priced existing home (currently about $299,000). Impressively, gold made all but the last month of this move without attracting mainstream attention.

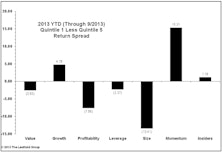

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

Valuation Metrics: Numerators & Denominators

Different measures of value may tell different stories. Using various metrics, we examine the valuation of Large Caps, Small Caps and equity sectors.

Elevated Short-Term Risks

The S&P 500 and NASDAQ Composite moved to new bull market highs in early September, but our quantitative work continues to warn there’s a least a short-term speed bump ahead for the stock market.

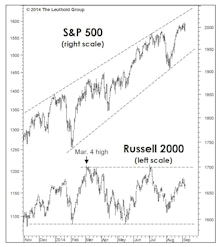

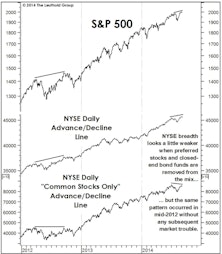

Market Breadth And Leadership

While the lagging action of Small Caps should be monitored, persistent strength in most stock market breadth measures makes it difficult to argue the stock market has entered a true “distribution” phase.

Stock Market Valuation Check

Stocks might look superficially cheap relative to bond yields, but they continue to offer little appeal in an “absolute” valuation sense.

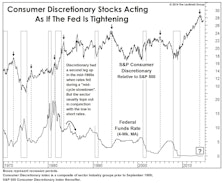

Why We Think Tapering Is Tightening

We believe the first move toward tighter policy occurred in January when the Fed first reduced the rate of its monthly bond purchases by $10 billion to $75 billion.

Premature Inflation Fears

With commodity prices falling in recent months and consumer prices in the Eurozone almost flat over the latest 12 months, we’re surprised that inflation fears continue to climb the list of U.S. investor worries.

Share Buybacks: They’re Not For Everyone...

Share repurchase activity in the S&P 500 dropped off in the second quarter, after first quarter buybacks challenged the all-time high levels seen in the second and third quarters of 2007 (a window of history that should ring a bell).

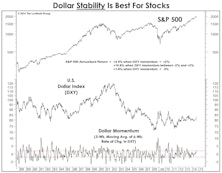

The Bond Bull And The Dollar

Surging bond prices in Europe have opened a yield gap with the U.S. This premium favors more dollar strength in the coming months. In equity markets, the short term volatility in the dollar is a mildly bearish signal.

Boring Is Best In The Forex Markets

Statistically, stocks perform a bit better in an environment of dollar strength than dollar weakness. The best stock market action, however, occurs when there’s relative calm in the forex markets.

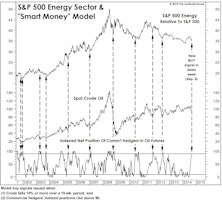

A Catalyst For Energy?

While a new secular bear market in commodities commenced in 2011, we still look for tactical opportunities in commodity-oriented stocks to arise from time to time.

Gold Set To Tumble Again?

Gold market fundamentals appear superficially bullish...

Relative Valuation Group Ranks

Consumer Discretionary and Information Technology produce six of the top ten groups.

Small/Mid/Large Caps

Small Cap Premium Bounces Back To 23%

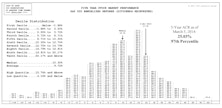

Long-Term Equity Performance Coming Up Short

The bull market has pushed short-term annualized performance readings well above median levels, while the longer-term readings remain subdued. But there is a silver lining…

Valuation: Today Versus The Late 1990s

We “mapped” current readings on six time-tested valuation ratios to the month in which those readings were first matched or exceeded as the late 1990s market bubble developed.

The EM Value Trap?

EM valuations look cheap in a stock market world that otherwise doesn’t. But even their “cheapness” bothers us.

Consumer Discretionary: End Of The Run?

Last month we suggested the top sector for 2013 would fall from grace in 2014, and the Consumer Discretionary stocks have been quick to cooperate in the last five weeks.

Secular Bull Or Bear?

Is a new secular bull market underway? New highs in essentially all U.S. undermine the argument from the shrinking pool of secular bears. But new converts to the bull thesis should be concerned about the valuation levels already reached.

Royal Blues: High P/E Tier Beats S&P 500

The High P/E Tier is now slightly overvalued, the Middle P/E Tier is overvalued, and the Low P/E Tier continues being quite overvalued.

Valuing The “Typical” Stock

Current median valuations are almost identical to those seen at the bull market highs of March 2000 and October 2007.

Last Target Standing?

The inflation-adjusted all-time high for the S&P 500 is currently 2061, a figure we think will be just out of reach for 2014.

Beyond P/E Ratios

Some of our alternative valuation measures find the market even pricier than P/E ratios do.

Stock Values: Absolutely, Relatively

The severity of the market’s current overvaluation depends on one’s historical vantage point.

Valuations & Future Returns

The U.S. market rates anywhere from mildly overvalued to very overvalued relative to other developed markets. Foreign markets might be the last remaining pocket of yield that isn’t overvalued.

Global Valuations Rising, But U.S. Still At A Premium

The large valuation discount on foreign shares has narrowed a bit, reflecting better relative action in foreign shares over the past 14 months and relatively weaker foreign fundamentals.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

Nothing But Clear Blue Skies Ahead? We're Not So Sure

With no obvious technical resistance left for the U.S. stock market, we’re skeptical of the “long cycle” view, primarily based on valuations and “provincial” data points.

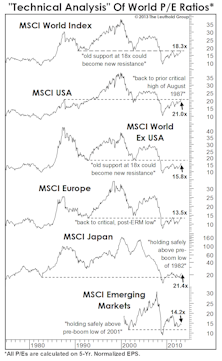

A Techno-Fundamental Take On The World

At 15.8x Normalized EPS, the non-U.S. developed world (measured by the MSCI World Ex USA Index) still hasn’t managed to recover to its old lows of 18x seen in both 1992 and 2002.

Of Special Interest: Valuing The Stock Market - Do Interest Rates Matter?

Models based on so-called relative valuations have a poor track record in practice, having misled investors at several historic inflection points. Interest rates have virtually no impact on stock market valuations, but they may have transitory effects on stocks in the short term.

Stock Market Observations

Under the “principle of alternation”—in which price patterns vary from cycle to cycle for the sole purpose of fooling market participants—the bull market is (in my view) unlikely to top out in the spring or winter of 2012.

Going (More) Global

MSCI Index very undervalued, as the recovery off the March 2009 lows has left valuations still near prior bear market lows. Relative to foreign markets, the U.S. looks expensive. This is why we continue to maintain a healthy exposure to foreign stocks…especially emerging markets.

View From The North Country

Valuation tools comparing stock earnings yields to bond yields (i.e. the Fed Valuation Model) are worthless. History shows they don’t perform very well at all.

Total U.S. Market Capitalization As A Percentage Of GDP: An Alternative Valuation Perspective

Total U.S. Market Capitalization As A Percentage Of GDP: Identifying “Fair Value.”

Irrational Exuberance Then & Now

Many investors have come to realize just how overvalued the stock market became in the late 1990s. Alan Greenspan may have been early with his comment about “irrational exuberance” in late 1996, but in hindsight his warning was warranted.

How Much More Is in This Market?

Clients are asking how much more is in this market? Herein we will attempt to provide an answer to this question, without the aid of charts, astrology, or Evel Knutson. Rather, we will employ over 60 years of historical valuation facts.