VIX

The MOVE Is Now A Better Risk Gauge

The MOVE index, a volatility gauge for the bond market, has become a far better risk barometer—and it surged to a new cycle high in March.

Will The Populist Game Stop?

We look at the recent short squeeze and examine how these populist movements affect the market performance in populist vs. establishment countries, and dig deeper into the regional versus sector effect.

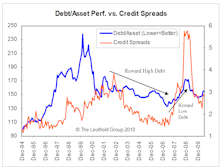

Leverage Factor: A Boost For High Quality Stocks?

A review of Quality factors, as well as the lower valuations of High Quality stocks, supports the current High Quality cycle amid rising market volatility. The Leverage factor may provide particularly strong backing for High Quality stocks.

U.S. Rates: Looking For A Dip

The U.S. 10-year ended the month 15 bps higher but non-U.S. bonds fared much better with bond yields in Europe and Japan 4-5 bps lower.

The Latest Sure Thing

A fascinating aspect of long-running bull markets is the emergence of money-spinning strategies that come to be seen as “sure things.”

Someday, Fear Won’t Be Bullish

Does this year’s incredibly low stock market volatility mean the end is near? History is inconclusive.

The Volatility “Sweet Spot”

Daily stock market volatility has levitated at levels a bit higher than the VIX—in a zone that has historically been “optimal” for short-term performance.

New Higher Risk Signal Generated But Optimistically Cautious

This new “Higher Risk” signal closed out the previous “Lower Risk” signal generated last December, and this measure is telling us it’s time to play a little defense.

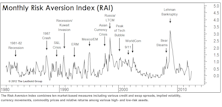

Risk Aversion and “Episodic” Factor Returns: Investors Favoring Conservative Characteristics

We expect risk appetites to remain low and investors to continue to reward conservative stock characteristics over the next 3-6 months.

Back To A Less Aggressive Equity Exposure

The “Fail-Safe” was triggered by the poor market action at the end of February, and we are moving towards a 50% net equity exposure. Caution seems prudent despite the Major Trend Index remaining in positive territory.

We're Bullish (And Hoping For “Small” Gains)

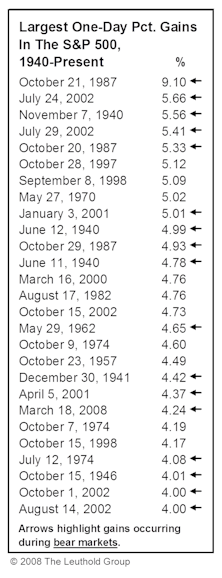

Improving cyclical leadership could be signaling that the bear market is in its final stages. In 10 of the 12 past bear markets, cyclical stocks turned up prior to the conclusion of the bear.

Getting A Fix On The VIX

August was an incredibly volatile month, and a month which saw the VIX Index explode to the highest level since 2003.

The VIX: Another View On Buy Signals

There does appear to be some validity to using relative highs on the VIX as short term Buy indicators.

The VIX: Volatility Increasing But Still Far From A Buy Signal

During May, the 10 day weighted VIX rose from a level of 11.7 to a peak of 16.7, prompting some to wonder if this work was signaling a buy signal. In fact, the VIX is now at the highest level since mid 2004, but this is still far from a buy signal.

What To Make Of The VIX?

VIX was a hot topic in April, as investors saw the increased volatility as a sign the market was poised to rally. Our long term studies of the VIX, results in us cautioning investors about reading too much into the recent move in this volatility index.

Market Sentiment: Currently A Mixed Bag

An in depth discussion of market sentiment...At present, it is a real mixed bag, there is no clear cut consensus.

Revisiting The VIX

While we still believe there are problems with the VIX as a sell signal, our study did reveal some validity in the 1997 to date period.

Dissecting The VIX Index

VIX Index not effective as a sell signal, but very good on buy side. Ignore talk of current low VIX reading foreshadowing a market decline.