Yield to Maturity

The Return Of Returns

A distinguishing feature of fixed income securities is that the expected return on a bond over its remaining lifetime is known with considerable certainty at the time of purchase. This characteristic can be a blessing or a curse, the negative aspect coming into play during an asset price bubble. Equity investors can justify almost any price as they dream of boundless riches arising from the bubble’s driving theme, limited only by their imagination. However, a bond’s yield to maturity is known at the time of purchase and this is the return investors in aggregate will earn. Even during the euphoria of an asset bubble, the expected outcome - the return of par value at maturity - is also the best-case outcome, and that is where our story begins.

Research Preview: Oh Bond Pain

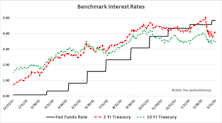

Here we evaluate the returns of fixed-income ETFs since the Fed began its boosting campaign last March; for many mainstream offerings, the picture is not a pretty one. We recap the pain felt by investors in conventional fixed-rate bond funds.