ACR

Long-Term Equity Performance Coming Up Short

The bull market has pushed short-term annualized performance readings well above median levels, while the longer-term readings remain subdued. But there is a silver lining…

Risk Premium For Stocks Making A Comeback

History appears to be repeating itself as the risk premium for stocks is making a comeback. Ten-year Treasuries are now the riskier asset class compared to equities.

Lookback Blues… Still Depressing Long Term Equity Performance

It’s easy to see why equity investors are so down when looking at updates of the long term stock market performance. It’s even more depressing when long term equity returns are compared to bond returns.

Lemmings Atop The Fixed Income Cliff....And How This Could Play Out Well For Equities

Get out in front of the lemmings. We expect to ultimately see bond funds reverse now that performance has been lagging the stock market. But where will the money go? Our best guess is that it flows to Emerging Country Equities….once again chasing strong performance.

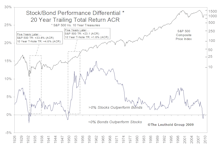

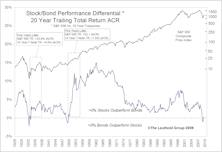

Righting The Ship Of Risk/Reward

As of the end of Q1, the 20 year total return ACR differential between the S&P 500 and Ten Year Treasuries was negative, and at its lowest reading in 60 years.

Generational Perspectives On Stock Vs. Bond Returns

So, over the long run, stocks are supposed to provide better returns than bonds as compensation for taking greater risk. Well the last 20, 30, and 40 year periods show that bond and stock returns have been at the smallest performance spreads ever. In some cases, bonds actually produced better returns. It’s pretty depressing huh?

Stocks Now Lag Bonds Since 1987 Bottom

The recent dismal stock market sell off, combined with flight to safety of U.S. Treasuries, has vaulted bond returns well above their historical norms while stock returns are well below their historical norms.

A Decade Lost....Why Sentiment Is Now So Bad And Opportunity Now So Good

The S&P 500 has produced an annual compound return of -0.9% per year for the last ten years (November 1998 through November 2008). This does, however, set the stage for very strong performance going forward.

NASDAQ Ten Year ACR Now At An All-Time Low...And Heading Lower

Demoralizing long term returns factor into why the investing public has avoided the U.S. stock market during the last several years — even during the bull market.

View From The North Country

2007 half time report. Revisiting our original 2007 projections with some current modifications. Outlook for stock market, interest rates, inflation, profits, economy, the deficits, the U.S. dollar and gold.

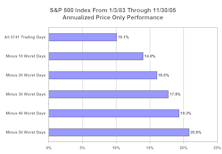

Debunking One Myth Of The Buy And Hold Rationale

Debunking one myth of buy and hold rationale. Showing how stock market returns change if investors avoid the best and worst performing stock market days. Essentially, anything can be proven with statistics.

Can Bond Market Returns Match Future Stock Returns?

It will be tough for bonds to keep up with stocks over the next several years even though stock and bond returns are neck and neck over the past twenty years.

Performance From A Long Term Perspective

Don’t let the roller-coaster ride of the short term lead to abandonment of sound, long-term investment strategies. Despite 2000-2001 declines, stock market performance over the last ten years is still beating long-term, median equity returns.

Looking At Stock Market Risk and Analyzing Past Bear Markets

A look back at 20 prior bear markets (1900 to date) to examine the question, “Just how long does it take to recover from a bear market?”

NASDAQ Performance In Longer Term Perspective

How have sharp declines of the past year affected performance over longer time horizons?

Bull Market Returns: Missing the Best/Worst Days

Is a market timing strategy superior to “buy and hold”? You can prove anything with numbers. Despite that, there does appear to be a supportive case for tactical asset allocation, or market timing.

Wall Street Meets Pennsylvania Avenue

Stock market returns for U.S. Presidents while in office. (Whig Party Presidents produced best average returns!)

Putting Proper Perspective Upon Performance

This has been the greatest bull market in history. Investors coming into the market in the last few years have garnered unbelievable returns. Over the last five years, the S&P 500 has compounded at an annual rate of 24.0%.

Goldilocks Economy, Blockbuster Earnings Recovery

Goldilocks economy keeps rolling along, but earnings recovery has been nothing short of spectacular.

Putting It In Perspective...A Look At Equity Performance Over Last 15 Years

Last 15 years have been the best 15 year stock performance period ever recorded. Many of today's investors expect this to be the norm. Next 3, 5, 10, or 15 year time periods cannot be expected to rival current returns.

View from the North Country

S&P performance gets “tech-less”. Tech stocks have only added 4% to YTD S&P performance and only 11% since 1970.

Regressing to the Median Equity Returns: Are We There Yet?

Our studies suggest we still have some further regression before returning to median returns. Looking out to a 3-5 year horizon, we expect equity returns to lag historical averages as returns regress further toward normal long term (10 year) performance.

Bonds: Guaranteed Long Term Underperformance???

Time for an attitude adjustment? We have seen some fat returns on long fixed income securities since rates peaked in 1981. What can we expect from bonds in the future? To help answer this question we look at three sample bonds using a 5 and 10 year risk/reward framework.

Stock Market Performance In Historical Perspective

A few months ago John Lillard, President of JMB Institutional Realty, had a great idea for us. One of John's suggestions was that we compile histograms of past stock market performance to help put the recent outstanding stock market performance in better perspective. Yes, some of our best ideas come from clients.