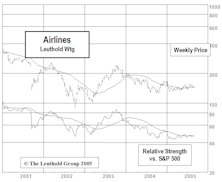

Airlines

Examining The “Reopening Economy” Theme At The Group Level

We examine a variety of industry groups with noteworthy relative price action on both “reopening” and “closed economy” days. Our objective is to shed more light on the industry groups that are consistently moving together on these days.

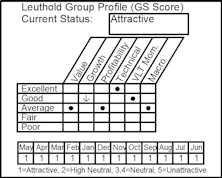

Airlines Travel To Attractive In The GS Scores

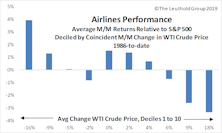

We look at our domestic Airlines’ GS Score and examine the historical relationship between oil prices and Airline stocks. Additionally, we explore several other data sets to determine where the industry’s supply/demand picture stands heading into 2019.

Highlighted Attractive Groups

Airlines rebounded after a brief dip to High Neutral; Health Care Distributors is scoring well across the board (other than Technical factors); Specialty Stores is cheap due to the changing retail landscape.

Highlighted Attractive Groups

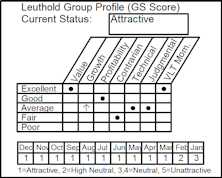

Airlines, Life & Health Insurance, and Household Durables are among the month’s intriguing opportunities based on the current Group Selection (GS) Scores.

Airlines Take Off This Week

Investment Banking & Brokerage and Airlines were this week's best groups. Tech Hw Stor & Periph and Automotive Retail were this week's worst groups.

Highlighted Attractive Groups

Airlines, Asset Management & Custody Banks, and Automotive Retail all have attractive Valuations and strong VLT Momentum.

Time For A Transportation Turnaround?

We examine the recent strength in the Dow Jones Transportation Index and its underlying industries: Airlines, Railroads, Air Freight & Logistics, and Trucking.

Highlighted Attractive Groups

Airlines has spent only three months below “Attractive” since early 2012 and the group’s factor category scores continue to provide solid results. We also like the growth prospects for Drug Retail and Apparel Retail.

Airlines Remain Attractive And Still Have Positive Fundamental Story

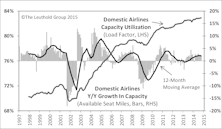

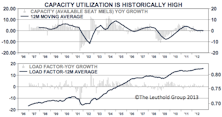

Even after several years of relative outperformance, Airlines currently ranks fourth highest among the 115 groups we track. Our confidence is supported by the compelling fundamental story. Management has been making disciplined decisions in the face of rising demand and falling fuel prices.

Select Groups Upgraded To Attractive

A summary of the GS Score strength for Airlines, Health Care Distributors, and Hypermarkets & Super Centers.

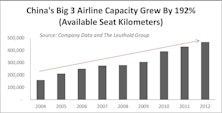

Global Airlines - Capacity Data Favors U.S. Airlines

Economic expansion and industry consolidation have created tighter capacity and improved performance for North American Airlines. Other parts of the globe are experiencing planned capacity expansion, a trend that will affect the entire industry.

Strength In Transportation: A Deeper Dive

Bull markets rarely come to an end prior to the Transports exhibiting weakness. Their outperformance continues this year, returning an impressive +9.9% through June 4th, almost doubling the S&P 500’s +5.2%. We examine the underlying Transport groups and assess which areas are providing the strength to help sustain the Transportation Index’s leadership.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations again this month, but we trimmed a few groups and added Commodity Chemicals. All group holdings currently rate Attractive. Global Industries had no changes. Emerging Electric Utilities, which we added last month, was the second best performing group in March.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations this month, and we made no significant changes to our group weights. All group holdings currently rate Attractive. Global Industries eliminated our longest tenured group, Regional Banks, which we held for two years. We added Emerging Electric Utilities, which is our first EM oriented group since June 2013.

Long Only Portfolios Down For The Month But Beat Benchmarks

Select Industries had no group deactivations, trimmed Consumer Finance and purchased Systems Software, further boosting our Tech holdings. Global Industries had no group deactivations, trimmed our Reinsurance and boosted exposure to Health Care, Industrials, and Info Tech groups.

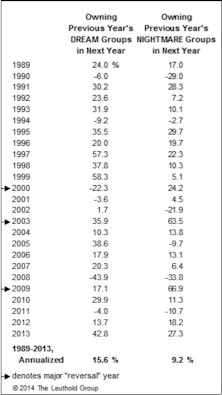

The Dreams & Nightmares Of 2013

For 25 years we’ve tracked hypothetical industry group portfolios comprised of the previous year’s “Dreams” (20 best performers) and “Nightmares” (20 worst performers).

Group Models: Finding Opportunity In Controversy

We like Attractive groups that make us cringe at the thought of potentially purchasing them. We take a peek at three groups - Airlines, Education and Managed Care - where we plugged our nose and bought.

Select Industries: Adding Aerospace & Defense Group

Aerospace & Defense was added to the portfolio this month.

Is Overcapacity A Problem For Emerging Market Airlines?

Airlines are Attractive in both group models, but there could be trouble on the horizon as emerging market carriers face the challenges of rapid growth.

Select Industries: Airlines And Rails Remain Largest Group Holdings

Group Deactivations, New Groups and best performing groups in May.

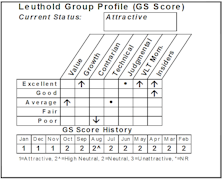

Still Flying With Airlines

While their scores remain strong, the underlying factor strength has shifted as these stocks have soared. Our quantitative disciplines and a compelling underlying fundamental story are keeping us in flight.

Select Industries Takes Flight With The Airlines

This group has been Attractive since March, and currently ranks fourth in our Group Scoring model. We think an improving fundamental story, coupled with a strong GS Score, is emerging from this ravaged industry.

Bought The Airlines...Ready For Another Profitable Round Trip

Establishing new Select Industries equity portfolio holding in Airlines.

View From The North Country

Leuthold shares summary comments on various subjects, such as Consumer Sentiment, and the dollar, among others. Also, airlines as growth stocks (?) and the 2006 Elections: the Incumbent advantage still dominates.

Why We Still Like Airline Stocks: Broad-Based Strength & Improving Fundamentals

So why do we still hold a position in Airlines? Short answer is: “Opinions are for show,but the numbers are for dough.” GS Score still rates group high in Attractive zone.

Adding A Position In The Airlines

Taking off with a flight on the Airlines. Added this contrarian play as a 5% portfolio holding. Group Selection Scores moved this group to Attractive in September, and most Airlines have made real progress reducing operating costs.

Airlines...Major

Sector employed in equity portfolio (Jan. 1997).

Sector Notes

A new sector “Buy The Numbers” is being added to the equity model this month. It is a hybrid quantitative theme that has been in the development stage at The Leuthold Group for a number of months.

View from the North Country

Snow Emergency Declared At The Leuthold Group...Holiday Wishes To All...Polling The Pro's (Leuthold Clients)...Northwest Airlines Battle Rages On...Mike Hamilton Frequent NWA Flier And Constant Skeptic Of NWA's Financial Aid Package

Our New Airline Play

In September and October, we viewed the improved market action of the “Airlines” as possibly only a knee jerk response to lower oil prices. But in November, oil prices strengthened and so did the airlines. Clearly, more was going on than just lower oil prices.

View from the North Country

A Swede jumps ship at the Leuthold Port, a month of much research recapped, hypocrites on the Hill and Airline miseries.

View from the North Country

Update on the coming Japanese Oil Patch invasion: We are now even more convinced, it is only a matter of time.…ARFF (Angry Revengeful Frequent Flyers) – You too can be a member!

New Airline Position

We are establishing a new 6% position in the airlines this month. I just heard five Wall Street firms put out new buy recommendations today. Let us hope the crowd is not always wrong.

View from the North Country

The February 23 memo advised clients of new tactical move into a package of major airlines, a 6 to 12-month tactical play. The sharp 23% decline in Airlines since Jan. 20 is viewed as a rare second opportunity to buy an industry in the midst of a profit surge at pre-recognition levels.