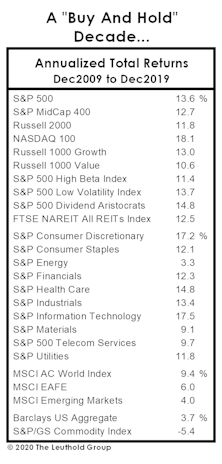

Annualized Total Return

Asset Allocation: A Rising Tide Lifts Most Boats

Boy, we thought policymakers had thrown the kitchen sink at the economy in 2020. Evidently, the Fed’s Marriner Eccles building has two kitchens, because they were able to do it again in 2021: M2 grew 13%, the Fed’s balance sheet swelled19%, and the 2021 federal deficit will come in at 12% of GDP.

What’s Your “Number?”

Those in their peak earning years (40s and 50s) who’ve also enjoyed the stock market’s windfall gains are very likely to have seen their annual expenses climb much higher than the Consumer Price Index over the last several years.

Golden Milestone

Fifty years ago this month, Richard Nixon formally suspended the convertibility of U.S. dollars into gold. Editorials commemorating this have tended to have a celebratory tone, and why not? Abandoning the gold standard greatly expanded the arsenals and imaginations of policymakers, both of which have been on historic display over the last 18 months.

The “Rule Of Twenty” Revisited

Pundits could reasonably argue the market has never been more expensive in light of the prevailing rate of inflation. That’s the conclusion of the “Rule of Twenty,” which proposes that the stock market’s P/E ratio and the trailing 12-month Consumer Price Inflation rate should sum up to 20.

Hard Facts Behind An Easy Job Market

Statistically, when jobs are “easy to get”—as all the survey evidence now indicates—attractive long-term returns for stocks typically become “hard to get.”

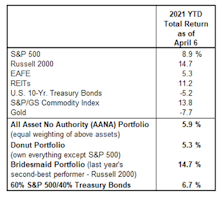

Time For A “Donut” Break?

Despite a resurgence in Small Cap stocks and Commodities, it still feels like an “S&P 500 World” for asset allocators. The financial media remain obsessed with S&P 500 targets, S&P 500 earnings, and S&P 500 stocks. And why wouldn’t they be?

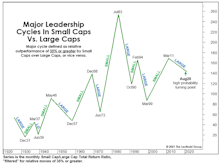

Small Caps: It’s Still Early

Technical analysts continue to be aghast at the relentlessly “overbought” readings generated by Small Cap stock indexes. However, last month we noted that such extremes had previously presented themselves only at the early or middle phases of a Small Cap leadership cycle—never at the end of such cycles.

Has Liquidity Peaked?

The last few weeks offer plenty of evidence that the mania has moved into a more feverish phase, yet the Fed insists that it is still “not-even-thinking-about ‘thinking about’” raising interest rates. That dismissive attitude could well whip up an even higher fever in the months ahead.

Rewarding “Perfect Foresight”

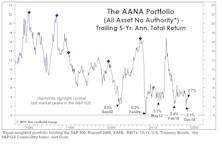

The AANA Portfolio could be viewed as representing one extreme of the asset allocation continuum—in which no knowledge of comparative asset valuations or economic conditions is assumed (or, at least, imparted). At the opposite pole would be the clairvoyant speculator who puts all of his or her eggs into one basket and holds that basket for the entire year.

Remembering Another “March Milestone”

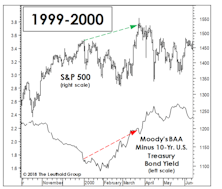

While the bull didn’t live to see his 11th birthday, this month did mark the anniversary of another historic event: Twenty years ago this week saw the peak bubble-era close in the S&P 500 of 1,527.46.

Rewarding “Perfect Foresight”

During the first five years of our career, we worked for a group of stockbrokers who, by each year’s end, seemed to have been gifted with perfect foresight on the major asset markets. Admittedly, we never saw their clients’ actual returns.

A New Year, Or A Blast From The Past?

It was during the very first days of the great 2019 market rally that we noted its similarities to the bubbliest of all the bubble years—1999. Wow. We had it in our hands and frittered it away.

AANA: The Good And The Bad

Large Cap U.S. Technology has been the place to be this year, but even an “unmanaged” portfolio with a variety of assets has fared well so far in 2019.

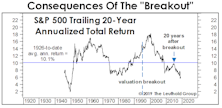

The “Breakout” And Its Aftermath

A common criticism of our long-term valuation work is that valuations shifted north into a new trading range during the 1990s, meaning Leuthold’s benchmarks (dating back to 1957 and earlier) are no longer relevant.

The Cycle Is Over If Confidence Fades Further

The “Expectations” component of the Consumer Confidence survey has been wobbly in the last few months, but the latest report, released on Tuesday, showed the first meaningful hit to consumers’ “Present Situation” since the stock market first began to struggle 14 months ago (Chart 1).

BAA Acting Baaaadly!

Whether or not they’ve risen for the “right” reasons remains up for debate, but the upward move in interest rates has hit the usual suspects very hard in 2018, like early-cycle industries and Emerging Markets.

Analysts, Summon Your Inner-Angler!

Quantitative investment firms are increasingly touting the cross-disciplinary backgrounds of their research staffs, with prior high-level experience in areas such as medical research and engineering not uncommon.

If You Think This Market’s Fishy, You’re Right

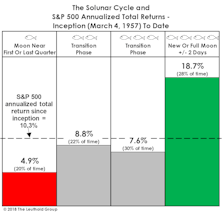

Tomorrow is the Minnesota season-opener for muskies, but the fanatics who chase them are likely disappointed that it comes a few days after an event that’s known to trigger these beasts: the full moon. The screenshot is from our $9.95 “iSolunar” iPhone app, and shows that Saturday merits only a “three fish” day (out of a possible “four fish”)—based on the moon’s fading illumination.

Foreign Stocks: What Will Turn The Tide?

After a brief respite last year, EAFE has reverted to its old form by falling 300 basis points behind the S&P 500 so far in 2018. EAFE’s main transgression might simply be that it represents good relative value in a market that’s been rewarding only momentum...

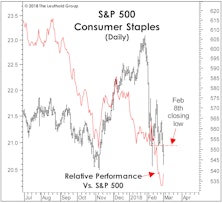

What’s Ailing The Staples?

The setback that began in late January qualifies as the sixth intermediate correction of the current bull market, where “intermediate” is defined as an S&P 500 loss ranging between 7%-12%...

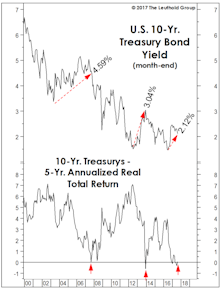

Bonds: No Pain, Yet No Gain

We find it remarkable that the five-year trailing real return on Treasurys has dropped to zero without investors having (yet) suffered any real pain.

Grappling With A Strong U.S. Dollar Outlook

Profitable investing overseas requires not one, but two, successful decisions: 1) select an outperforming asset class; and, 2) be in a currency that provides a favorable foreign exchange impact.

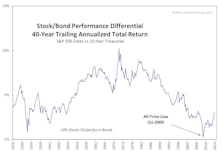

Exploring The Historical Relationship Between Stock And Bond Returns: An Update

We were surprised to see that all differentials ten years and longer are still below their respective 1926-to-date medians, indicating they still have the potential to keep moving towards historical median levels. We expect stocks to outperform bonds going forward.

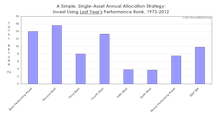

Bridesmaid Revisited: Do You Buy Strength Or Weakness?

Our “second best really is best” analysis comes up with an asset class we like and a sector we hate, plus trying it monthly doesn’t work out quite the way we thought it would.

Growing Investor Frustration

An extract from Leuthold & Anderson’s second quarter client letter.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)