Asset Allocation Strategy

It’s Been Ugly Across The Board

Aside from a couple specialized approaches, 2022 is shaping up as the second-worst year for “multi-asset” investing since at least 1973. It seems money printing supported more than just the equity subset.

Bridesmaid Track Record

With last year’s Bridesmaid (REITs) having laid an egg, the long-term “alpha” of the Bridesmaid portfolio narrowed to +3.7% from a bit over +5% (annualized) when we first published this study more than a decade ago.

Momentum Across Asset Classes

In the extreme case where one possesses no other information beyond last year’s total returns, the best single-asset strategy has been to buy the second-best performer (the “Bridesmaid”) and hold it for the next twelve months in hopes that the prior year’s momentum will carry it through. That approach has beaten the S&P 500 by 3.7% annualized over the past 48 years.

Tough Times For Allocators

Diversified, multi-asset portfolios have been weak performers for many years. The ultra-flexible, macro hedge-fund manager represents one extreme of the asset allocation continuum. At the other extreme would be the passive holder of multiple asset classes. It’s been a tough three years for this breed, too.

Bridesmaid Track Record

Here are the historical annual performance results for the hypothetical Bridesmaid strategy.

Momentum Across Asset Classes

For those not blessed with clairvoyant asset selection ability, we’ve developed a simple single-asset portfolio strategy that’s handily beaten the AANA Portfolio and the S&P 500 over the long-term.

Rewarding “Perfect Foresight”

During the first five years of our career, we worked for a group of stockbrokers who, by each year’s end, seemed to have been gifted with perfect foresight on the major asset markets. Admittedly, we never saw their clients’ actual returns.

Read This Before Taking The “Plunge”

After a bad market year like 2018, there’s a natural instinct for allocators to skew portfolios toward assets with poor recent performance. History suggests, though, that one shouldn’t make a habit of buying an asset on the basis of price weakness alone.

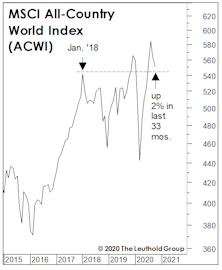

For Asset Allocators, As Bad As It Gets!

During 2018, no major asset class has done well, and in most respects the opportunity-set available this year has been among the worst in the last 50 years.

Asset Allocation: Buy Strength Or Weakness?

The turn of the calendar seems to bring out the inner contrarian in some investors—those who will peruse last year’s list of lagging asset classes looking for rebound candidates.