Bear Market

Another Stab At The “Downside”

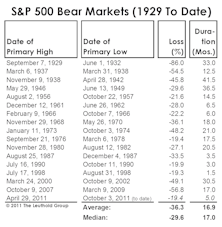

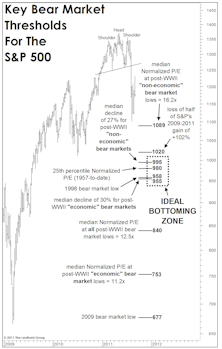

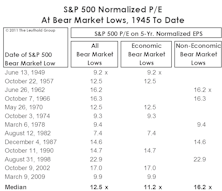

How far might the S&P 500 fall in a recessionary bear market? The 2002 and 2020 stock market lows were both produced by “recessionary” bears; based on history back to the 1920s, those two lows stand out as the priciest bear market bottoms on record—and it’s not even close.

“Toro Nuevo” Or Mirage?

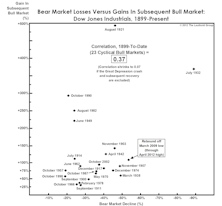

While our breadth measures do not consider this rally to be thrust-worthy, when based on nothing more than performance, it’s difficult to distinguish between the “first up-leg” in a new bull market and a bear-market rally. The vital signs at present appear to be more in-line with the latter (although making that conclusion based on price action, alone, is hardly better than a coin toss).

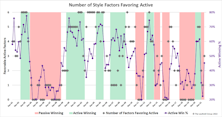

The Active/Passive Performance Cycle Second Quarter 2022 Update

The performance derby between actively-managed portfolios and passively-managed index funds is a topic of ongoing interest for Leuthold clients and the investment community at large. Therefore, we are providing an update to all charts and tables of our Active/Passive performance analyses.

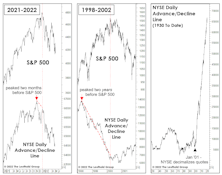

Not Dot-Com

Bulls have been quick to assure us that this market “bears” no resemblance to the dot-com bust. We agree—but probably for very different reasons. Among them are the conventional breadth measures, which provided little warning of this year’s January peak. And, the initial decline off January’s top has been much broader than during the first phase of the dot-com bust.

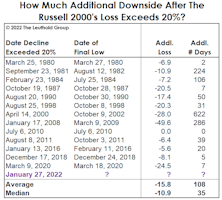

Two Ways To Spin The Russell 2000 “Bear Market”

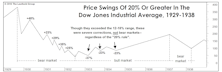

At the market’s January 27th close, the headline blared, “Russell 2000 Enters Bear Market.” Well, not exactly. If one accepts that a 20% decline constitutes a bear market, then the bear actually began on November 9, 2021—the day after the Russell 2000 peak.

How Much Inflation Is Too Much? It’s A Moving Target

In the latest Green Book, we noted that Producer Price Inflation does not usually become a challenge for the stock market until its annual rate breaks above 4.0%. The day that comment was published, the year-over-year gain in the March PPI for Finished Goods spiked to 6.0%, thanks mostly to the well-celebrated COVID-19 anniversary-effect.

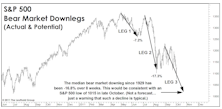

A Bear Market In Price, But Not Time

We have a hard time accepting that the excesses associated with an eleven-year bull market and expansion can be fully expunged in 27 trading days, no matter how ugly those days were… keep some powder dry!

Leadership Rotation And Bear Markets

Bear markets are the financial system’s version of the changing seasons—a cycle we “enjoy” to extremes here in Minnesota.

Sentiment Has Been Crushed, But Might Need To Just Languish For A While

We didn’t see the coronavirus coming and, like millions or perhaps billions of others, underestimated its likely economic impact when it began to spread. But stock market risks were high well before the virus hit.

How Sharp Is This Falling Knife?

While it’s possible that Monday’s S&P 500 low of 2,386 will represent an important trading low, we believe it is too early to expect the market to form a major bear market low.

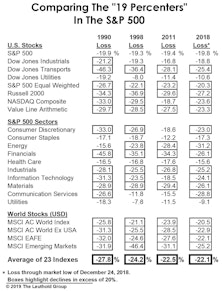

How This ‘Borderline’ Bear Stacks Up

The S&P 500 has again shown its mysterious ability to defy the conventional bear market threshold, with the decline into its Christmas Eve low becoming the fourth one in the last 30 years to halt just shy of the magic -20% figure.

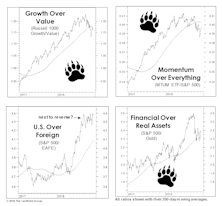

It’s Not A Pause… It’s “Paws”

A bear market will almost always prove to be the catalyst of one or more shifts in long-term market leadership.

Anatomy Of A Dollar Bear Market

With the dollar index breaking below the 2017 low, we believe the dollar bull market that started in 2011 (based on the trade-weighted dollar index) is most likely over.

There’s Always A Hook...

Bear markets need a “hook”—some sort of misdirection that keeps the majority hoping. Our work suggests a primary bear market is underway, and we fear oil is this bear’s hook…but the problems run deeper than oil.

Was That All There Was To It?

As quantitative investors, the disciplines of the numbers trump stories—even our own. But we’re struck that the stories depicted by our Major Trend Index and other market tools over the past two years are entirely logical and sequential. Unfortunately these stories rhyme with those of past market cycles.

NYSE “New Lows” Figures Point To “Lower Lows”…

At the August and late January S&P 500 lows, both the Daily and Weekly NYSE New Lows figures exceeded 40% of Issues Traded —a degree of downside thrust rarely seen outside of bear markets.

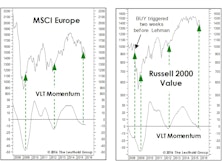

Learning From Failures?

There’s an old trader’s adage which holds that “the most powerful sell signal is a failed buy signal.” Last fall we noted that European equities and Small Cap Value had triggered BUY signals on our Very Long Term (VLT) Momentum algorithm.

The “Star” Is Aligned For 2016

Valuations are high. Market internals are weak. And the MTI is negative. But for those seeking some truly authoritative evidence that there’s stock market danger ahead, consider the accompanying cycle chart unearthed from a gossip column in a 1958 issue of the Minneapolis Star.

A Bear Till Proven Otherwise

Major Trend Index remains decisively negative at 0.72. The “market action” category is the primary culprit behind this bearish tally, but we’ve also seen the Economic category deteriorate in recent months and would expect this trend to continue. This sequence is typical: Market action leads economic trends (and, we would argue, is a major cause of those trends).

The Bear Case: "Before And After"

The Lesser Of Two Evils?

Last month we wrote that we had no interest in playing even an “oversold bounce” in the precious metals, and our view hasn’t changed. Crude oil has already fallen to its long-term, inflation-adjusted mean; if gold does the same, its downside extends below 700.

Equal Opportunity?

While the Major Trend Index, at 0.90, is now in its negative zone, it’s not as if all the traditional bearish bellwethers have lined up in a row (… then again, they never do).

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

Little To Complain About

From a pure price action perspective, it’s difficult to find cracks in the bull market’s edifice.

Industry Groups: No Need To Bottom-Fish

Buying global groups with strong price momentum has been a winning strategy. Will it continue?

An “Old” Bull Market… That Should Get “Older”

The bull market is increasingly showing signs of advanced age, but that is only to be expected for a move that now measures 40 months off its March 2009 low.

Major Trend Bending, But Not Breaking...

The April/May swoon (an S&P 500 loss of -9.9%) has been accompanied by significant deterioration in our Major Trend Index. But the latest reading (data through June 1st) stayed positive, and our best guess is that it will hold firm.

Start Of A New Bond Bear Market Or Not, There Is No Need To Rush

Whether it’s the start of a new bond bear market or not, there’s no need to rush... and why shorting bonds may not be the best idea, even during a bond bear market.

Ain’t Nobody Happy

Despite the big October rebound, Doug Ramsey examines various market players and finds that dissatisfaction with recent market moves may proliferate among all but a select few.

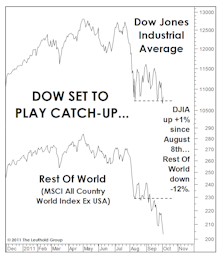

Worse Than It Looks… And Not Over

Most costly market decoy in the last six weeks has been unusual (relative) strength of the Dow and S&P 500 indexes. Resilience in blue chips is characteristic of the early and middle phases of a bear market, but recent blue chip performance has been so stellar (again, in a relative sense) that most investors curled up comfortably in the “correction” camp…while small caps, cyclicals and virtually all foreign markets were screaming “BEAR!”

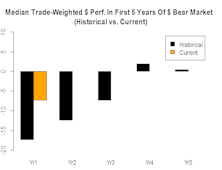

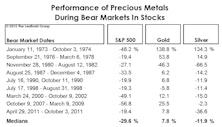

Bear Market Facts—A Refresher

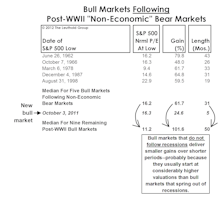

This month’s “Of Special Interest” examines the bear market facts. Doug Ramsey doesn’t expect the current bear market to reach historical bear market medians in terms of decline or duration. Non-economic bear markets are usually much shorter than recession-induced bears.

Another Swoon Coming

Several U.S. indexes and world stock markets have already lost 20% or more from recent peaks, satisfying the parameter for a bear market.

Recession Or No Recession? That ISN’T The Question

Doug Ramsey provides an analysis of non-recession related bear markets. Historically, non-recession related markets are shorter in duration than recession induced bear markets, but the decline is essentially the same magnitude.

A Non-Economic Bear?

A market decline much beyond 20% could be labeled a “non-economic” bear market. Outstanding feature of past “non-economic” bear markets has been their brevity.

Bull Market Milestones: How the Current Bull Stacks Up to Past Cycles

This month’s “Of Special Interest” examines the characteristics of past bull market recoveries. Using a variety of historical comparisons, the current recovery is put into some perspective. The majority of these comparisons seem to indicate the current recovery still has a ways to go.

Be A Buyer In An October Scare

Following a strong September, October may be a little weaker. However, readers should use any October scare to buy equities in anticipation of strong end to 2009.

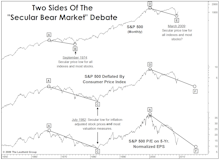

“Secular” Is In The Eye Of The Beholder

Secular versus Cyclical markets. It shouldn’t really matter. Investors can lose a lot waiting to be right. The Key is to focus on the cyclical movements within a secular bull or bear market.

Has The Stock Market Come Too Far Too Fast?

Lots of pundits calling for a double dip recession. In this month’s “Inside The Stock Market” Doug Ramsey questions their rationale and uses history as a guide to say that we don’t think so.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)