Bonds

Bonds: Not A Four-Letter Word

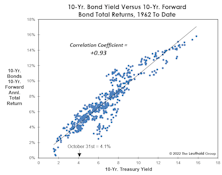

The bond market bubble has popped, and forward-looking Treasury returns are no longer a disaster. We aren’t suggesting one pile into them with yields near 4% and inflation around 8%, but we think they have suffered a much more substantial de-rating than large-cap stocks.

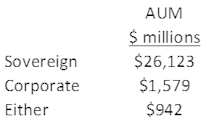

The World Of Emerging Market Bonds

Investors looking to diversify away from the U.S. interest rate environment and/or the domestic business cycle may wish to consider Emerging Market bonds, an asset class with lower correlations to the U.S. Agg. Bond Index. EM bond investors can choose between several investment attributes to find the risk / return profile with which they are most comfortable. This study surveys the investment tradeoffs offered by each sub-category, as defined by ETFs focused on each particular asset class.

Research Preview: Emerging Market Bonds

The U.S. Aggregate Bond Index lost 3.8% in April, bringing its year-to-date return to an agonizing -9.5%. The realization that bonds can lose big money, combined with the outlook for stubbornly high inflation and continued rate increases, is nudging bond investors to consider a wider scope of alternatives.

Investment Grade Widened More Than High Yield: Implications & More

As credit spreads widened, something rather unusual happened: investment grade Corporate bonds performed far worse than High Yield bonds.

Bond Market Partially Closed For The Holidays

To use the old cliche' for lack of a better term, the bond market backed and filled in December.

Bonds, Breadth, And Leadership: A Simple Model

Hard-core statisticians might be disappointed to learn that the 140-ish inputs in our Major Trend Index (MTI)aren’t entirely “independent and uncorrelated.”

Bond Bubble Spills Into Equities

The S&P 500 once again remains on the verge of a new bull market high, thanks in large part to the bubble in another asset class: Bonds.

Millions Of Citizens Become “One-Percenters…”

While the collapse of Swiss government bond yields into negative territory was January’s bond market stunner, our “G7” composite 10-year government bond yield reached its own milestone when it closed the month below 1.0% for the first time in post-WWII history.

U.S. Bonds

Given the higher volatility and increased risk aversion, high grade credits are attractive as the negative relationship between rates and credit spreads dampens the volatility of this asset class.

U.S. Bonds

The thin liquidity likely magnified the move in both rates and credit spreads, but we continue seeing a friendly macro environment that supports high quality credits.

Exploring The Historical Relationship Between Stock And Bond Returns: An Update

We were surprised to see that all differentials ten years and longer are still below their respective 1926-to-date medians, indicating they still have the potential to keep moving towards historical median levels. We expect stocks to outperform bonds going forward.

US Bond Grades

The renewed participation of credits in the risk asset rally is a welcome sign.

US Bond Market - October 2013

We are encouraged by the narrower spreads in October as the feared divergence between credits and equity markets did not continue.

Our Position on U.S. Bonds

U.S. Investment Grade Corporate Bonds: Favorable, U.S. High Yield Corporate Bonds: Neutral, U.S. Municipal Bonds: Neutral

U.S. High Yield Corporate Bonds: Maintain Neutral

On the positive side, the fundamental picture is still healthy for most U.S. high yield issuers, and defaults are expected to be low. On the negative side, weakening inflation expectations is a divergence that bears close monitoring. We will exercise patience and wait for a better entry point.

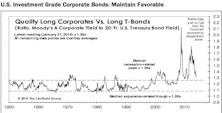

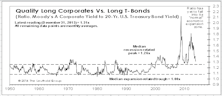

U.S. Investment Grade Corporate Bonds: Maintain Favorable

This is consistent with our overall cautious view on credits. Credit spreads continued narrowing despite higher volatility in the bond markets.

U.S. High Yield Corporate Bonds: Maintain Neutral

Over the past few months we’ve seen the largest high yield bond fund outflow since 2000. We will exercise patience for now and wait for a better entry point.

U.S. Investment Grade Corporate Bonds: Maintain Favorable

Despite the exodus from all bond classes in the last few months, longer term demand for safe spreads is likely to remain strong and investment grade issuance has dropped significantly.

"Muddle Through"

The global economy is stuck in a “muddle through” mode with developed and emerging countries showing divergence in terms of leading indicators. Despite this divergence, they share one thing in common: an upturn in inflation. How much more room there is for easing is a key determinant of asset market performance.

Risk Aversion Sharply Lower—But Optimistically Cautious

We remain optimistically cautious, as we believe the determination of the policy makers to prop up the market should not be underestimated, especially in an election year.

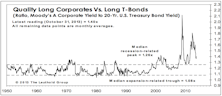

Bi-Modal Or Middle Of The Road—We Think The Latter

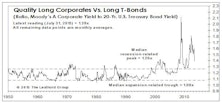

How do we avoid volatility in a high Uncertainty/low conviction world? We compare a “bi-modal” portfolio of 50% Treasuries/50% High Yields with a “middle-of-the-road” portfolio of 100% Investment Grade Corporate bonds. The latter wins in both good and bad scenarios.

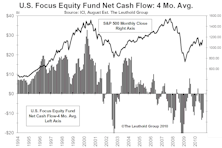

Nightmare On Main Street: Individuals Are About To Get It Wrong…Again

There were plenty of interesting facts to be discovered in reading the latest mutual fund flows report from the Investment Company Institute (ICI). The recently released report, which detailed the statistics for September, showed that there were nearly $15 billion of net redemptions from U.S. equity funds for the month. September, by the way, was a month where the S&P 500 rallied to an 8.8% gain. We have noted in the past that the public is generally a trend following herd that buys into market strength and sells on weakness.

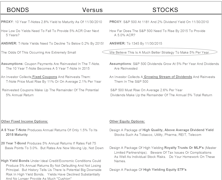

Slowly Righting The Ship Of Risk And Reward

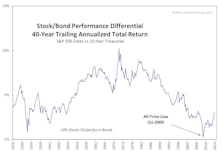

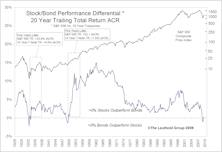

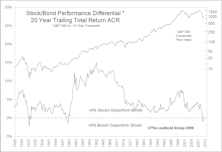

Stock/bond Risk-reward relationship beginning to return to normal. Back in Q1 2009, performance differential between S&P 500 and 10 year T-bonds was at generational lows. In prior periods of bond superiority, stocks ultimately came soaring back. Expect to see stocks do much better over next 5 years.

Rising Interest Rates Don’t Prohibit Rising Stock Prices

Expect stock prices and interest rates to move higher together for a while. There are plenty of examples of this historically...although some of them go waaayyyy back.

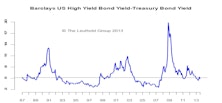

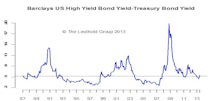

Time To Take Some High Yield Bond Profits

High Yield bonds are still rated Attractive, but the spreads have narrowed significantly.

Righting The Ship Of Risk/Reward

As of the end of Q1, the 20 year total return ACR differential between the S&P 500 and Ten Year Treasuries was negative, and at its lowest reading in 60 years.

Update On Our Stock/Bond Performance In Focus Special Study

Despite strong stock market returns relative to 10-year Treasuries, the “generational anomalies” still exist. Stocks should outperform bonds going forward.

Are You Smarter Than A Bond Investor?

During the past several years, it has become fashionable to believe that bond investors are more sophisticated than stock investors. Personally we don’t buy that bond investors have any edge in intelligence or diligence.

Generational Perspectives On Stock Vs. Bond Returns

So, over the long run, stocks are supposed to provide better returns than bonds as compensation for taking greater risk. Well the last 20, 30, and 40 year periods show that bond and stock returns have been at the smallest performance spreads ever. In some cases, bonds actually produced better returns. It’s pretty depressing huh?

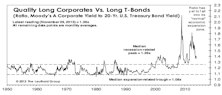

"Spreading" The Message

Credit spreads have blown out to levels not seen since the 1930’s. What are the implications for the market?

High Yield Bonds: Start Accumulating

High Yield bonds have reached our attractive zone at yields of nearly 14%. To us, a gradual accumulation program makes sense.

Bond Sentiment: Window Closing For Bulls?

Since economic fundamentals are providing little help lately, an understanding of bond sentiment has become especially helpful.

Bond Sentiment: Still A Short-Term Bullish Pillar

We see little fundamental appeal in bonds at current yield levels, but would not be surprised if yields still drifted a bit lower in the next month or two—if only because so many players are positioned for the opposite.

2007 Outlook: CPI Stabilizing First Half And Economy Chugging Ahead Slowly

Bond yields continue to fall as economic reports have tended to be on the weak side. Massive global liquidity and the search for yield have also helped to push yields lower. We have been way off the mark with our predictions for higher rates.

Bond Market Correction Did Not Happen In October

Our call for a bond market correction did not pan out in October, but yields did back up in early November as weak productivity and a surprisingly low unemployment rate were released.