Bubble

Bubble Or Not? Two Valuation Takes

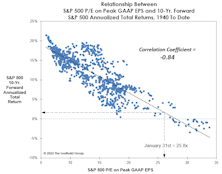

In early 2018, we thought the market was expensive, but certainly not a bubble. Today, the trouble is not just high P/E multiples, but the sustainability of the “E” itself—with profit margins nearly 20% higher than ever before. Whether one believes U.S. Large Caps are engulfed in a bubble or not, we have a P/E ratio for you.

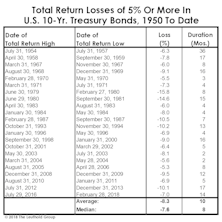

“Unlevered” Treasuries Aren’t A Bubble

It’s been popular to argue that U.S. government bonds are a bubble while U.S. equities are not. But even if we agreed, the potential cyclical total return losses in Treasury bonds are a fraction of those likely to occur in an equity bear market.

Today Versus The Tech Bubble Peak

We’ve generally spoken of the market’s “broad participation” as a good thing. And from a purely technical point of view, it is.

Technology: Popping The “Bubble” Talk

The S&P 500 eclipsed the “Twin Peaks” (2000 and 2007 highs) in 2013, and two years later the NASDAQ topped its 2000 high.

Long On Equities, Light On Conviction

In the wake of the tech wreck and the housing bust, usage of the term bubble by the media and market pundits has become increasingly liberal.

Bond Bubble Spills Into Equities

The S&P 500 once again remains on the verge of a new bull market high, thanks in large part to the bubble in another asset class: Bonds.

Millions Of Citizens Become “One-Percenters…”

While the collapse of Swiss government bond yields into negative territory was January’s bond market stunner, our “G7” composite 10-year government bond yield reached its own milestone when it closed the month below 1.0% for the first time in post-WWII history.

Party Like It's 1999?

Over the last 6-months the "asset-bubble" label has been recklessly attached to Tech stocks. But that label is not right as the "Tech" decline has been concentrated in NASDAQ Internet Index names while the broad Tech sector is near an all-time high.

Technology’s Prospects For Long Term Leadership Looking Good

Nine Technology groups are in the top quintile of our group model, and the sector has strengthened on a relative basis after twice “testing” a trendline that dates back to the early 2000’s tech wreck. There’s reason to believe the new uptrend has longer-term legs.

Handicapping The High In Housing

Today it seems taken for granted that the great housing meltdown of 2006-2010 was sufficient to purge the last decade’s excesses, and that housing can now be relied upon as one of the drivers of a slow but elongated U.S. economic expansion.

The Bond Bubble Is Beginning To Deflate… Is This Cheap Money Era Ending?

Long term interest rates could continue rising, as inflation expectations increase and investors demand higher yields.

View From The North Country

In my opinion, the U.S. stock market is entering the terminal phase of the current cyclical bull market, based on our historical studies of typical cyclical bull market duration and magnitude. To a lesser degree the same can be said for the economic expansion.

View From The North Country

A special Kate Welling interview with Steve Leuthold. Discussion runs the gambit from Leuthold’s current outlook for the stock/bond markets, to groups he favors, to liquidity concerns, and hedge funds.

View From The North Country

Leuthold outlines three conditions for “fixing” Social Security: Increased Retirement Age, Index Benefits To Price Index, and Means Testing.

View From The North Country

Weighing in on the current stock market positives and negatives currently being discussed by clients and Wall Street strategists.