Business Cycle

The LEI Clock Is Ticking

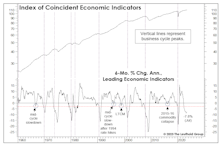

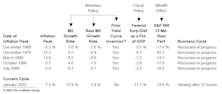

A contraction of 3% or more in the LEI’s six-month annualized rate-of-change has always been associated with a recession, with an average lead time of four months. Using that guideline, the most recent recession warning was triggered in June 2022, and the lead time is now approaching the longest ever recorded (16 months in 2006-07). If today’s lead time matches the 2006-07 experience, the business-cycle peak will occur in October.

The 2022 “Tax Hike” Repealed!

In the last twelve months, spending on energy goods and services as a share of total consumer outlays dropped by 1.1%—that amounts to about $200 billion in savings (annualized).

Has The Stock Market “Eased?”

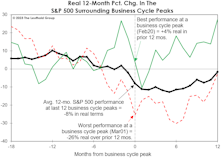

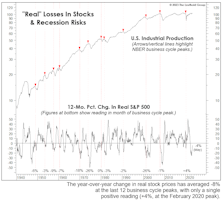

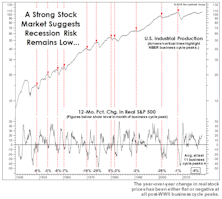

The path of real stock prices in the current cycle looks very different from the typical pre-recessionary track. In fact, based only on the chart of performance in real terms since January 2022, we’d probably believe the economy has recently emerged from recession.

Maximum Inversion?

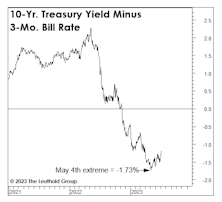

Factoring in both the duration and depth of the existing yield-curve inversion, it is considered more severe than all predecessors since the 1960s. Even Duke University yield-curve guru, Campbell Harvey, abandoned his January forecast that a recession would be avoided.

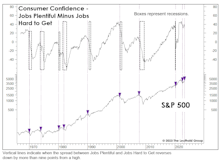

Job Market Deja Vu

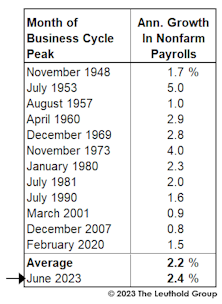

With leading economic measures still trending down, optimists who advocated against fighting the Fed during the free-money era have ditched their own advice. Their focus is now on lagging indicators, like the employment numbers—but that last bastion of strength seems ready to buckle.

Even The Labor Market Looks Recessionary

We think the stock market is skating on pre-recessionary thin ice, an endeavor that, admittedly, can be both irresistible and (temporarily) profitable.

Watching The Wealth Effect

“Real” stock-market wealth has declined considerably since late 2021 without yet delivering a knockout blow. But if the other key evidence detailed throughout this section is on the mark, that wallop is lurking in the very near future.

What “Causes” Inflation To Decline?

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

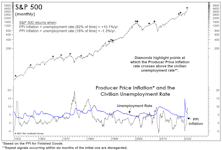

The Inflation Surge In Context

Inflation is already “too high” for the current cyclical setting, and the level of inflation that equity investors are willing to tolerate will drop further as the economy recovers.

Stocks And GDP

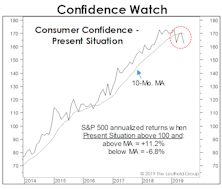

Economists argue the best thing the stock market has going for it is the continuation of the U.S. economic expansion. Maybe.

More Yield Curve Musings

The U.S. yield curve inversion has lasted long enough that even a few economic optimists now concede it will ultimately prove significant.

Recession Evidence: How Much Is Enough?

Over a 12-month horizon, we now believe a U.S. recession is very likely, but aren’t confident enough to make the call when the forecast window is cut in half. Second-half stock returns could be decent if the business-cycle peak is still a year away. Then again, there’s peril in waiting for “too much” confirmation of recession.

Mid-Year Mea Culpa

The S&P 500 has rallied 9.2% in the 22 trading days since its June 3rd low, but the move hasn’t (yet) been enough to lift the Major Trend Index out of its negative zone.

Recessions & The Stock Market

In the last couple of months, we’ve come across a handful of economic “check lists” purporting to show the relative absence of recession harbingers as the expansion closes in on its ninth anniversary this summer.