Commodities

Financials Improve; Commodities Tumble

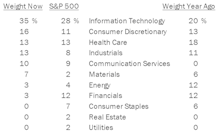

While it was a small jump, from #6 to #5 in the sector composite ranks, Financials might be seeing the start of overall improvement. Conversely, Materials and Energy continued to drop in the latest ratings, as fundamental measures deteriorated.

More Signs Of Peak Inflation

As suggested in our June 24th, Chart of the Week, the peak in consumer inflation (+8.6% in May) has likely either occurred or is imminent. Consumers should thank the stock market, which in 2022 has taken up its occasional role as inflation-fighter after the Fed abdicated throughout 2021.

If Inflation Has Peaked, Thank The Stock Market—Not The Fed

High inflation continues to dominate the headlines, but it is only one piece of the “weight of the evidence” that’s stacked against the stock market. Still, in ironic fashion, stock-market action itself suggests that inflation is set to peak.

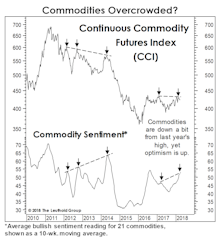

Commodities Cooling In 2022?

It’s easy to misread where the true “consensus” stands on any financial forecast. Here’s a disconnect we see in current consensus thought: The “crowd” seems broadly bullish on commodities, yet the same crowd (previously known as Team Transitory) thinks consumer price inflation is near a cycle high.

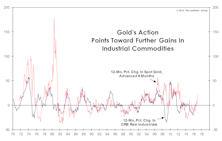

Gold: Still A Useful Dollar Hedge

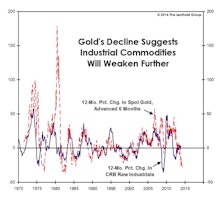

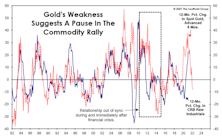

A stronger U.S. dollar is “supposed” to be bearish for commodities, but it’s been a banner year for most commodities with gold among the few that are down on the year. However, keep in mind that gold tends to be a harbinger of major moves in industrial commodities, with a lead time of about six months—and its year-over-year change is now negative.

Energy: Still Too Early

Fundamentally, we don’t have much new to say on the disaster that Energy-sector equities have become. Mostly, we want to illustrate the danger of assuming that the stocks of commodity producers will necessarily follow the path of their underlying commodities.

Five Reasons To Expect Higher Yields

Much of what we think “we know” about the bond market says yields should be headed higher.

Commodity Comeback?

Many analysts thought the last cycle would end with a bit of “fire” in the form of higher commodity and consumer prices, and they might well argue they would have been right if not for the eruption of COVID-19.

Assessing The Commodity Free-Fall

For at least two years, the unofficial title of “the scariest chart in the Leuthold database” belonged to the S&P 500 Price/Sales ratio. That chart still rattles us, with the July month-end ratio still in the vicinity of its old Y2K high.

Icing Over?

Will this economic cycle end with “fire” (overheating) or “ice” (a whiff of deflation)? Interestingly, hedges against both outcomes have performed well in recent months, with both gold and Treasury bonds spiking. For many reasons, though, we believe the U.S. expansion is more likely to end in a deflationary bust.

Non-Energy Commodities Signal A Major Slowdown

Late in the cycle, blue chip indexes like the DJIA and S&P 500 can fool investors by hiding subtler deterioration in the broad list of stocks. That’s been underway in the last couple of months, but it’s nothing in relation to the divergence that’s opened in the commodity market, where there’s an almost 20% YTD performance gap between the headline S&P/GS Commodity Index and its non-Energy components (Chart 1).

Sifting Through The Commodity Carnage

Commodities were the worst performer among the major asset classes during 2018, with the S&P/Goldman Sachs Commodity Index losing 13.8% on a total return basis.

Time To Get Contrary With Commodities?

After a strong 2016 and a “Bridesmaid” (i.e., sector runner-up) performance in 2017, the Materials sector seemed primed to benefit from the “late cycle” character of the economy in 2018.

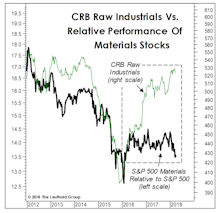

The Commodity Bull That Equity Investors Missed...

While the bottom-line impact may ultimately be the same, there’s one thing we find more demoralizing than getting the direction of an asset wrong: getting the direction right and not getting paid for it.

A Troublesome Commodity Pattern...

During each of the last five months, the U.S. economy has shown a broadening array of “late-cycle” characteristics.

The Commodity Stock Disconnect

We’ve chronicled the ever-expanding gap between commodity prices and commodity-oriented equities. Don’t expect a rebound in one based on the strength of the other. There’s no clear historical tendency for the weaker asset to catch up.

Commodities: How Strong Is Too Strong?

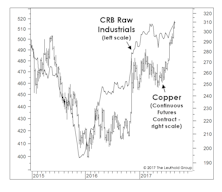

While the bond market doesn’t believe it, the past couple of months leave no doubt that the U.S. industrial economy has recovered from the energy-related slump of 2015-2016.

Stock Market Observations

The Major Trend Index stabilized in a moderately bullish range during the past several weeks, yet the Momentum/Breadth/Divergence category is almost the sole carrier of the bullish torch.

Commodities: More To Come?

Commodities have enjoyed a strong year thus far, and the GS Scores on the Materials sector have followed suit (albeit with a slight lag), as highlighted in June’s “Of Special Interest” section.

Thoughts On The Commodity Bounce

The global economic expansion will enter its eighth year later this summer, yet the world’s central bankers continue to fight deflationary demons as if it’s 2008.

Has The Hook Been Set?

Two months ago, we suggested a short-term bounce in oil might prove to be the fundamental “hook” that would rationalize a bear market rally. We thought a bounce to $45 might do the trick—and oil futures essentially cooperated, reaching $41.90 on March 22nd.

Where’s The Profit Leverage?

Industrial commodity prices and the latest ISM figures both point to a stabilization in the manufacturing sector following a two-year deceleration. Expectations for this year’s earnings have turned more optimistic as a result, but are the hopes warranted?

Muddle-Through Still Has The Benefit Of The Doubt

The market’s latest infatuation with bonds was driven by grave concerns that the weakness in energy and manufacturing sectors might be spreading to the U.S. economy as a whole.

Surveying The Commodity Carnage

The wreckage is beginning to look interesting and—with our cautious stance on the stock market—it would be fun to be bullish about something. Both our GS Scores and intuition suggest it’s still too early.

What’s Driving EM Currency Weakness?

A strong dollar and low commodity prices are major forces dragging down EM currencies across the board.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

Commodity Washout?

Oil’s 60% decline in the last nine months has been the headline-grabber, but the remaining components of the Continuous Commodity Index (CCI) deserve some love, too.

Sector Margin Trends

The S&P 500 record median profit margin of 10.3% is now almost a full percentage point above the last cycle’s peak of 9.4% (second quarter of 2007). Trends across S&P sectors are not as uniform as one might expect, though, with only half of the ten sectors last quarter at profitability levels that exceeded their 2001-2007 expansion highs.

The Surprising Winners In Emerging Markets

While we expect an eventual break in this relationship, today Emerging Market equities are following, fairly tightly, the cycle of industrial commodities—a cycle that rolled over (on a secular basis, we believe) in 2011.

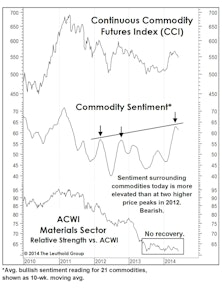

Commodity Sentiment Crushed, Yet Commodity Stock Valuations Above Boom Levels

We’ve been negative on industrial commodities for some time, reflecting the persistently (and unsustainably) high levels of investment evidenced by our Global Group analyses of commodity-oriented industries.

Commodity Bears (i.e., Everyone) Should Read This

The commodity “oversupply” story remains intact, with high levels of capital spending in the Energy and Materials sectors persisting, despite the 3 1/2-year downtrend in commodity prices.

Correlation Breakdowns

We’d rather eat broken glass than have to forecast financial market correlations, but that doesn’t mean we ignore them altogether.

Commodities: Not A New Bull

The year’s second biggest surprise (next to the relentless drop in bond yields) might be the YTD bounce in the major commodity indexes.

The Bull Market Turns Five

The post-2009 stock market upswing now qualifies as only the sixth cyclical bull market since 1900 to last five years or more. But only three of the previous five-year-old bulls lived to see a sixth birthday.

High Correlations And Their Meaning

While our tongue-in-cheek “Correlation Of Everything” measure has retreated from record levels, it remains far above anything seen prior to 2010.

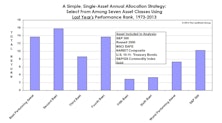

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Commodities In 2014: Supply Remains A Concern

While gold garnered most of the headlines last year (down 27%), commodities performed badly across the board in 2013. We expect more of the same in 2014.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

A New Leg In The Commodity Decline?

For more than two years we’ve discussed the supply-side risks to commodity producers stemming from capacity built during the manic “Third Act” of last decade’s Three Act Play in commodities. Commodity-oriented equities have indeed underperformed since 2011, but to date, most pundits have laid blame squarely on the demand side.

Gold’s Implications For Other Commodities

Gold’s recent weakness may be more ominous for industrial commodity investors.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)