Commodity Prices

Sifting Through The Commodity Carnage

Commodities were the worst performer among the major asset classes during 2018, with the S&P/Goldman Sachs Commodity Index losing 13.8% on a total return basis.

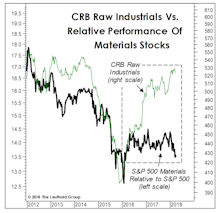

The Commodity Stock Disconnect

We’ve chronicled the ever-expanding gap between commodity prices and commodity-oriented equities. Don’t expect a rebound in one based on the strength of the other. There’s no clear historical tendency for the weaker asset to catch up.

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

Five Reasons Inflation Is Still Missing

Overall demand slack, stubbornly low velocity of money, an overall stronger dollar, painfully low labor cost inflation and weakness in commodity prices are strong disinflationary forces.

Commodities: Still Worried About Supply

Commodity producers seem to believe that last decade’s commodity boom is set to repeat. This belief itself probably ensures that it won’t.

Evidence of Near Term Commodity Inflation Building

A month and a half ago we became concerned with rising commodity prices, which has been especially obvious over one and three month time horizons. Those trends continued in March, with several of the commodity indices now showing double digit price increases from three months ago.