Consumer Discretionary

Be Contrary On Discretionary

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy. This study examines the Consumer Discretionary (CD) sector’s behavior in recessionary times, with the goal of understanding the typical performance pattern during economic lows in order to help investors position their portfolios for a potential recession.

Research Preview: Recessionary Discretionary

While sentiment on the potential for a recession by year-end is split, there is little dispute that it’s an important question for cyclical sectors. Consumer Discretionary is most exposed to the business cycle, and we are interested in understanding its prospects as we head toward a potential economic slowdown.

Additional Factors

The S&P 500 had an almost biblical upheaval to start 2023. The “last were first” and the “first were last.” In January, the 100 worst performing stocks of 2022 had an average return of +16.1% while last year’s 100 best performers posted +1.7%.

Additional Factors

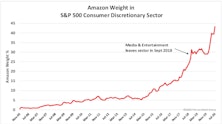

The six-week rally that started mid-June featured advances from AAPL (+25%), AMZN (+30%), and TSLA (+39%), which accounted for one-fourth of the S&P 500’s gain. Despite the recent preference for Value, a spike in interest rates, and the bear market, the index’s concentration in the top-five firms is still near it’s all-time high set in August 2020.

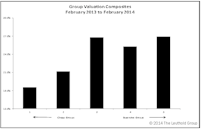

A Tale Of Two CDs

Investors considering a position in the Consumer Discretionary sector need to be aware of what they are buying: a basket in which one-half consists of mature, modestly-valued consumer brands, while the other half is two mega caps with excellent growth profiles and high absolute valuations. It would be a mistake to view this sector as a homogeneous set of companies.

Danger For Discretionary?

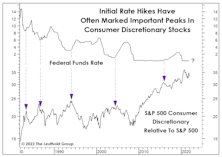

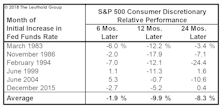

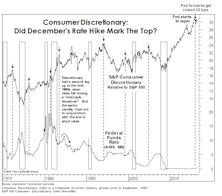

It’s been so long since investors have faced a serious Fed tightening episode that they may have forgotten a helpful rule of thumb: An initial hike in the fed funds rate is usually a good excuse to dump some Consumer Discretionary stocks.

Discretionary And Industrials Decline Rapidly In Rankings

Not much has changed at the top of our sector rankings in recent months, with Financials, Energy, and Info Tech in the top three positions. But, we have seen a very rapid decline with two sectors, Consumer Discretionary and Industrials. Over the past several months, these cyclical sectors have sunk to the bottom of our ratings. Here we take a look at what has caused this dramatic drop.

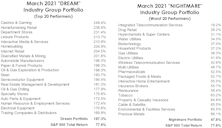

Industry Group Dreams & Nightmares—The Bear Market Edition

Given that we've recently passed the one-year anniversary of the bear-market bottom of March 2020, we thought it might be interesting to apply our annual Dream/Nightmare exercise to periods following bear-market lows; the idea here being that a major market bottom may serve as a “reset” for new industry trends.

Consumer Discretionary: Neither Fish Nor Fowl

The combination of rebounding economic activity and a surging (peaking?) enchantment with mega cap growth stocks is pressing investors to make an important tactical call: whether to take profits in some highfliers and shift assets to sectors with more cyclical exposure and better valuations.

Research Preview: Not Your Parents’ “Discretionary”

The combination of rebounding economic activity and a surging enchantment with mega-cap growth stocks is pressing investors to make an important tactical call: whether or not to exit some highfliers and shift assets to sectors with more cyclical exposure.

S&P 500 Sector Leaders Since Market Top

Since the market peak on February 19th the S&P 500 Health Care sector is down only 1.1%. Among the S&P 500 sector indexes, Health Care and Consumer Discretionary are the performance leaders.

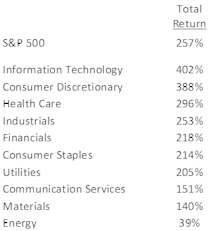

Industry Returns: The Decade’s Winners & Losers

This “decade in review” edition examines the performance of sectors and industries, looking at the best and worst groups to reveal the stories they have to tell.

Sector Rankings

The top-three rated sectors are Health Care, Communication Services, and Consumer Discretionary. Scoring lowest in the latest rankings are Energy, Materials, and Financials.

Sector Rankings

The top-three rated sectors are Communication Services, Health Care, and Consumer Discretionary. Scoring lowest with the latest ratings were Materials, Energy, and Industrials.

Sector Rankings

The top-three rated sectors are Health Care, Communication Services, and Consumer Discretionary, with Information Technology dropping from the top-three. Rounding out the bottom end of the rankings, for the second consecutive month, are Materials, Energy, and Consumer Staples.

Sector Rankings

For the sixth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. Rounding out the bottom end of the rankings are Materials, Energy, and Consumer Staples.

Rates Are Already Clobbering Consumer Stocks

“Three steps and a stumble” was the old rule of thumb for timing the impact of Fed tightening on the stock market.

GS Score Sector Rankings With Attractive & Unattractive Rated Industry Groups

Consumer Discretionary can’t be topped; it has held on to the highest-rated spot for seven consecutive months. Utilities and Telecom continue to close out the bottom two.

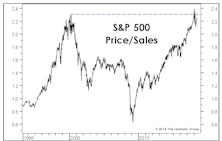

Altitudes Are Too High— And Attitudes Are Getting There

An important feature of this bull market—and a reason for its longevity—is the slow recovery in investor attitudes relative to valuation altitudes...

Sector Rankings

Consumer Discretionary has held on to the highest-rated spot for six consecutive months. Coming in last (again) is Utilities. After rating among the lowest two positions between April 2017 and April 2018, Energy finally improved and now sits in 6th place—the middle of the pack.

Consumer Discretionary Holds At #1

This year we’ve written several notes surrounding the Consumer Discretionary sector’s prominence among our top Group Selection (GS) Scores. This pattern persisted for a fifth consecutive month in April.

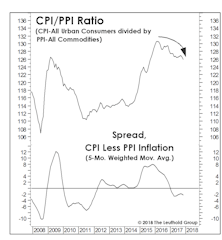

Keep An Eye On “Relative” Inflation

While our Group Selection (GS) framework hasn’t yet warmed up to commodity-oriented industries, our macro work suggests perhaps it should.

Consumer Discretionary Back On Top

Of the 110 industries in our framework, the top seven are all Consumer Discretionary.

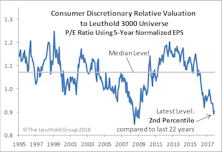

A Contrarian “Late-Cycle” Play?

The Amazon Effect masks both the underperformance of the average Discretionary stock and the relative value that’s been reestablished across the sector. “Discretionary ex-Amazon” is a better contrarian pick than Energy.

Retail Fades; Other Consumer Themes Flourish

Shifting consumer preferences and the relentless rise of e-commerce are changing the sector’s beneficiaries of the healthy backdrop away from retail, yet other Discretionary opportunities abound outside of the traditional retail groups.

Discretionary: Is The Top Finally In?

Sector swings have been wild enough thus far in 2016 that Consumer Discretionary’s relative weakness has drawn little commentary.

GS Score Sector Rankings, and Highlighted Attractive Groups

Health Care, Consumer Discretionary, and Financials are the top three rated broad sectors.

Health Care & Consumer Sector Strength Explored

While we view the industry group selection as the most important decision, looking at the sector level rankings also helps us identify broad trends. Here we highlight the top two rated sectors, currently, which also represent a combined >40% weight in our Select Industries Portfolio.

Can Consumer Discretionary Relative Strength Continue?

Despite this sector’s extended outperformance, we think this trend may persist in the near term as Discretionary industry groups look increasingly attractive within our group work. Keeping an eye on the Fed Funds rate is key, however.

New Highs = Neutral

We remain positioned with below-average net equity exposure in tactical portfolios for now. We’re inclined to think there may be more trouble ahead for the stock market.

Automotive Retail Shines In A Dimming Sector

We examine the highly ranked Automotive Retail group and explain why, despite its recent strength, it may still have room to run.

Late March Reversal… And The First Shall Be Last

We examine the impact of March’s strong group leadership reversal on the top and bottom of our group model.

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

Consumer Discretionary: End Of The Run?

Last month we suggested the top sector for 2013 would fall from grace in 2014, and the Consumer Discretionary stocks have been quick to cooperate in the last five weeks.

2013 Factor Performance: What Worked? What Will Keep Working?

Momentum and Value worked in 2013. Materials and Financials were the easiest sectors to exploit; Discretionary and Tech the most difficult. Momentum works in December; Value and Small Caps at the start of the year.

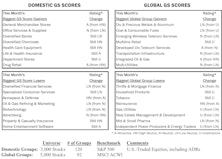

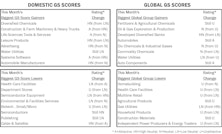

Group Models: Info Tech Tops Domestic, Financials Remain Atop Global

Both models have numerous Information Technology and Financials groups in Attractive territory. Neither model has any Unattractive Tech groups. Alternatively, neither model has any Attractive Utilities groups, while several Utilities rate Unattractive in each.

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

Key Observations On Q2 S&P 1500 Earnings

Year-over-year EPS growth rate for companies with Q2 reports (with about 65% in) currently stands at +4.2%, while revenue growth has come in at a better than expected +2.6%.

The Short Side—Still Ahead YTD

Our AdvantHedge Composite lost 5.9% in July, lagging the inverse performance of the S&P 500 (5.1%), but outpacing both the NASDAQ (6.6%) and the Russell 2000 (7.0%) as the market returned to “risk-on” mode.