Consumer

Lo And Behold, Another RATIO!!

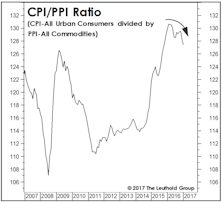

For managers who must remain fully invested in equities (or “paid to play,” as we’ve often called it), the level of inflation might prove a less important consideration than its character.

Another Take On The Inflation Debate

While there’s understandable obsession over the likely level of inflation (especially with the year-over-year CPI dipping below zero in the past two months), equity managers with no interest or skill in inflation forecasting might be better served by monitoring the character of inflation—i.e., whether it was led by changes in consumer or producer prices.

GS Scores in 2014

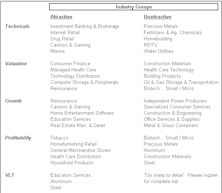

Looking forward, groups from the Information Technology, Health Care, Consumer Discretionary, and Financials sectors look appealing.

Stock Market Leadership In 2014: Large Caps, Tech, Health Care

Following a great year for trend-following, capitalizing on key reversals in sector performance will be important in winning the 2014 performance derby.

Commodities: Still Worried About Supply

Commodity producers seem to believe that last decade’s commodity boom is set to repeat. This belief itself probably ensures that it won’t.

Thoughts On China Investing: Domestic Consumption Versus Infrastructure Play

Jun Zhu makes a compelling case for focusing China equity exposure on consumer stocks. Increases in bank “Required Reserves” mandated by China government will have greater impact on Infrastructure stocks, while consumerism is still being supported and encouraged.

Market Mood Swings

Bull market still intact, but investor appetite for risk remains subdued. April’s preference was for defensive and conservative strategies. Old axiom “Sell in May and go away” doesn’t seem to apply during the 130 days leading up to election day.

View From The North Country

Individuals are sincere about investing appropriately, but get virtually no advise about risk. Also, putting the speed and volatility of the internet revolution in perspective.

The Message of Phillip Morris

Six months ago, this stock was at the top of most institutions' core holding list. Smashed and broken, it's now a major portfolio embarrassment. Once again, the often forgotten message from the past echoes: No Growth Is Permanent.

The Outlook Is Bright For "Consumer Lite"

The evidence is building.

Consumer Growth Stock Bargains

In recent months we have been increasingly impressed by the improving relative performance of consumer growth stocks. This month a four stock package of consumer growth stocks was introduced as a formal portfolio sector.

The Graying Concept Expanded: The “Graying Consumer”

The consensus way to play the “Graying of America” has been via health care related stocks. But the “Graying of America” is not just a play on health care for the aged.

View from the North Country

Aussie Bonds Attractive Once Again...MTA Seminar...Copper Update...The Age Wave Consumer...Bullish? Gold Charts

Results of the June 14, 1984 Screen Tests

Jim Floyd has run new computer screens for the Consumer High Growth sector, Regional Bank Double Plays, The Undervalued & Unloved issues and the Growth Stock Bargain Basket.

How Much Longer Do the Consumer Stocks Have?

Many consumer stocks are no longer especially cheap, even when 1983 earnings are considered. Nor has the increase in consumer demand most were expecting materialized. While consumer stocks rallied strongly with the strong August market and did not flounder in the September consolidation, they are certainly no longer the mighty market leaders they were earlier in the year. These factors combine, creating a vague uneasiness concerning consumer stocks.

Consumer Growth Stocks

The new computer screen produces 49 candidates for purchase and a new quantitative evaluation formula tells us “buy the numbers” which are “best.” Two of these “best” were added to model portfolio this issue, Walgreen and Alberto Culver.