CRB

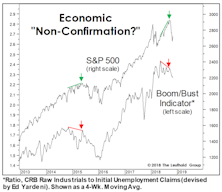

Too Soon To Expect Economic Weakness?

We believe stocks have begun to discount a major inflection point in the economy and corporate profits for 2019 and 2020.

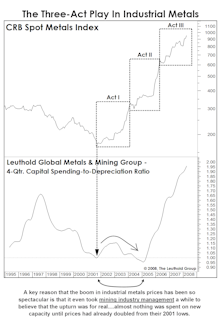

Time To Get Contrary With Commodities?

After a strong 2016 and a “Bridesmaid” (i.e., sector runner-up) performance in 2017, the Materials sector seemed primed to benefit from the “late cycle” character of the economy in 2018.

The Commodity Bull That Equity Investors Missed...

While the bottom-line impact may ultimately be the same, there’s one thing we find more demoralizing than getting the direction of an asset wrong: getting the direction right and not getting paid for it.

Stock Market Observations

The Major Trend Index stabilized in a moderately bullish range during the past several weeks, yet the Momentum/Breadth/Divergence category is almost the sole carrier of the bullish torch.

Thoughts On The Commodity Bounce

The global economic expansion will enter its eighth year later this summer, yet the world’s central bankers continue to fight deflationary demons as if it’s 2008.

The Bullish Case: A Mental Exercise

We’ve been correctly positioned near our tactical portfolios’ equity minimums, yet we’re oddly compelled to use this month’s “Of Special Interest” section as a very public second-guessing of that move.

Avoiding Gold

The vast majority of recent gold commentary centers on its extremely oversold technical condition and the related washout in all sorts of sentiment indicators, ranging from trader surveys to futures and options positioning. Maybe these conditions will produce a short-term bounce, but we’re going to stand with the message of our bearish longer-term work.

Another Kind Of Decoupling?

We’ve discussed the interrelationships between industrial commodities, commodity-oriented equities and Emerging Market stocks. Getting one’s bet right on any of these three has generally led to profitable positions in all three. But that certainly hasn’t been true in recent months.

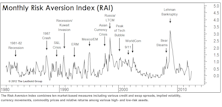

New Higher Risk Signal Generated But Optimistically Cautious

This new “Higher Risk” signal closed out the previous “Lower Risk” signal generated last December, and this measure is telling us it’s time to play a little defense.

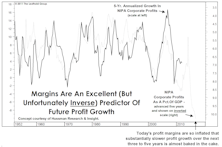

Profit Margins: As Good As It Gets

Current record high corporate Profit Margins examined in this month’s “Of Special Interest.” Topics include the sustainability of the trend, commodities as profit trackers, margins as a potential forecasting tool and discussion on profits by sector and market cap.

Estimating The Upside: Yes, We Still See Some

Despite our still (cautiously) bullish outlook, historical P/E levels which once provided support to the stock market are expected to now offer resistance as the market moves higher.

Commodity Curtain Call?

Inflation is peaking and the GS Scores did a great job signaling an exit from the Industrial Metals play. Commodities were hit hard in July.

Industrial Metals: Now Over-Mined?

Waiting for the curtain to fall on Industrial Metals, we recap the “three acts” and throw in a time-tested contrarian indicator to boot.