Cycles

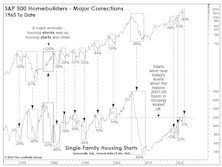

The Housing Market Is A Trip!

In mid-May, S&P 500 Homebuilders officially became a COVID “round-tripper”: After a one-month COVID collapse of 53% and an ensuing rally of almost 250%, this year’s selloff drove Homebuilders to a May 11th close that was a few ticks below its pre-COVID high. Imagine what might happen if the housing market cracks?

Cycles: Is The Worst Yet To Come?

Does the market’s poor YTD performance prior to the six-month “Sell in May” combined with the Presidential Election Cycle help “inoculate” it against a typical mid-year, mid-term swoon? Yes, there’s some evidence to support that view—especially with Small Caps.

Cycles: A Key “Window” Is Approaching

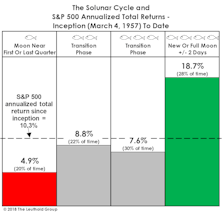

Next month kicks off the seasonally-weak phase of the stock market’s Annual Cycle: May-October. Overlaid on that is the statistically vulnerable stretch of the four-year Election Cycle: the “mid-point” of the Mid-Term Year. There’s a positive way to spin this mid-term malaise: The cycles imply that an ideal window for a major low is about to open.

The “Star” Is Not Aligned For 2022

When we entered the business in 1990, our grandmother mailed us a decades-old clipping from a Minneapolis newspaper featuring a columnist’s cryptic take on a hand-rendered chart. He coyly claimed to have found it in “an old desk”—and it wasn’t until the internet age that we’d learn of its unattributed source.

Q'Val: A Factor Powerhouse

Quant researchers widely agree that Value offers a return premium over time (although not recently) and that High Quality also offers excess returns. The Quality angle seems contrary to intuition, in that investors generally prefer Quality companies and are willing to pay up for them, yet Quality regularly outperforms. Value and Quality are both well-respected investment factors, and we were curious to explore the interaction of these two smart beta stalwarts. Is Value enhanced by adding a layer of Quality, thereby avoiding value traps, or are Value investors better off buying junky, unattractive companies that have the most room to rebound from depressed prices?

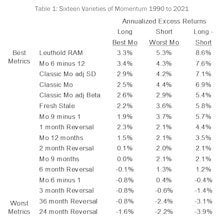

Can Mo Outrun A Bear?

Hiker #1: Can you run faster than that hungry bear looking at us?

Hiker #2: I don’t need to run faster than the bear, I just need to run faster than you.

The Momentum style of investing has a long history of generating excess returns, and ranks near the top of the list of essential smart beta factors. However, Momentum also has a dark side; it is prone to severe drawdowns whenever the market makes a significant reversal.

Active Vs. Passive Return Drivers March 2021 Update

Our ongoing research into the relative performance of active vs. passive styles reveals that market conditions play a significant role in the active/passive return cycle. We identified a set of metrics that describe the market conditions we believe influence which management style is more likely to outperform. This note updates our data through March 2021.

Valuation Extremes: Here Be Dragons

Top decile valuations are often the result of unduly positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Because bullishness manifests itself in aggressive valuations for speculative companies, we believe the prices being applied to such companies - for which intrinsic value is dependent on a future that looks significantly different than today - are an excellent measure of investor sentiment. In that spirit, we examined past cycles of extreme valuations with the goal of understanding how they relate to investor sentiment and what they might tell us about market conditions and relative returns.

Research Preview: A Tale Of Two Tails

Top decile valuations, such as those in place today, are usually the result of excessively positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Leuthold research typically tracks valuation sentiment by examining median P/E ratios, but in this study, we are taking the opposite tack. Rather than looking at medians, we are focusing on the outliers in each tail of the valuation distribution.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Time To Revisit “Why We Normalize Earnings”

With an economic calamity and the Easter season upon us, we thought this would be a great time to resurrect our “Why We Normalize Earnings” vignette. Long time readers will recognize this as a staple from Green Books’ past.

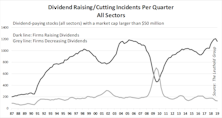

Return Implications Of Dividend Cuts

Last month we noted that current interest-rate expectations might indicate good timing for dividend investments; however, we strongly suggested being selective, and lean toward high-quality dividend payers.

Factors And Sectors: A Curious Entanglement

Portfolio managers who tilt toward Value or Growth stocks have long known that each style carries with it an inherent bias toward some sectors and away from others. Our recent piece, Value Style’s 100-Year Flood, highlighted the significant role that sector weights (overweight Financials and Energy, underweight Technology) played in Value’s decade-long stretch of underperformance.

Analysts, Summon Your Inner-Angler!

Quantitative investment firms are increasingly touting the cross-disciplinary backgrounds of their research staffs, with prior high-level experience in areas such as medical research and engineering not uncommon.

Cycle Collision?

The coming months form a bearish cross-section of two of the most prominent calendar anomalies: “Sell In May,” and the Presidential Election Cycle (in which the mid-term year is statistically the weakest). Between the two, we’d have to rate the former as more powerful and statistically persistent.

A Tactical Approach To Successful Factor Investing

Executive Summary

- Factors are investment characteristics that represent anomalies under the Capital Asset Pricing Model (CAPM). Securities possessing these desirable traits earn excess risk-adjusted returns beyond those predicted by CAPM.

A Study On Closed End Funds

In March 1991, an article titled “Investor Sentiment and the Closed-End Fund Puzzle” was published in The Journal of Finance.

The Intelligent Use Of Smart Beta

Quantitative investing has become an integral component of professional investment management, and smart beta funds have become popular vehicles for advisors as they assemble actively-managed client portfolios.

Factor Investing And The Importance Of Market Cycles

While factors do offer excess return they are by no means winners in all seasons. Our findings show that factor returns are cyclical, volatile, and unstable over time.

How Will It All End?

Last month we described ourselves as “long on equities, but light on conviction,” and that description still applies.

The Surprising Winners In Emerging Markets

While we expect an eventual break in this relationship, today Emerging Market equities are following, fairly tightly, the cycle of industrial commodities—a cycle that rolled over (on a secular basis, we believe) in 2011.

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

New “Lower Risk” Signal Generated

Bond Market Risk Aversion Index fell in December, resulting in a new “lower risk” signal that closed out the “higher risk” signal which occurred back in May. We are now cautiously optimistic.

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

A new High Quality Cycle has clearly emerged and is going strong. Note that the previous High Quality Cycle started at the end of 2007 and lasted more than a year.

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

High Quality Stocks outperformed their Low Quality comparators in the second quarter, and we find signs that a new High Quality Cycle is starting to take off.

Now Entering Increasing Risk Aversion Environment

Risk Aversion Index accelerated in May, making it prudent to favor defensive assets near term. Expect small and gradual increase in long term interest rates.

Insight Into The Cyclicality Of Equity Valuations

In this month’s “Of Special Interest”, Eric Bjorgen looks at the cyclical nature of P/E ratios. The normalized P/E ratio follows an expansion/contraction cycle that has been repeated five times since 1926, but the interesting thing is that the cycles have lengthened significantly over time.

Update On Non-Farm Payrolls....Buy Signal Likely With November Data

Non-farm payroll data is poised to register a buy signal for the stock market in early December. Using the year over year rate of change has historically been very effective in identifying recession-related market bottoms.

View From The North Country

Steve discusses his opinion of market cycle sin this month’s “View From The North Country”. He is a believer in cycles, but not so sure about rhythmic cycles. Also, his thoughts on the importance of market history.

Getting Later In The Game For The Bull Run

Getting late in the game for the bull run. This is no longer a young bull market, but we continue to believe the market can still move higher from here.

View From The North Country

Kate Welling Interviews Steve Leuthold: The Leuthold Group’s commonsensical adherence to investment disciplines, thoughts on rising inflation, attractive investment opportunities, Iraq, the reliability of U.S. government calculated statistics and estimates, and an abundance of other topics along with engaging banter.

.jpg?fit=fillmax&w=222&bg=FFFFFF)