Cyclical Bear

Bear Market Rallies In Context

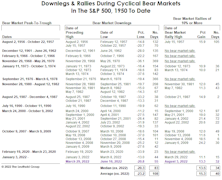

The 2022 bear market is the 13th cyclical bear since 1950, and it’s already joined the mightiest half of its predecessors based on the fact that it’s actually contained a bear-market rally. Six of the prior 12 bear markets weren’t interrupted by even one rally of at least 10%.

Looking To Credit For Clues

One of the first cautionary signals to emerge during the market’s two-year topping process was the failure of spreads on low grade corporate bonds to return to their early-2018 cycle “tights,” despite last year’s surge to new stock market highs.

A “Best Case” Bear Scenario?

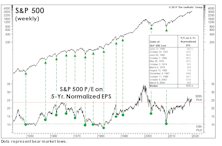

We intentionally curtailed our discussion of stock market valuations the last few months to allow the “dead horse” to recover from the thrashings administered in recent years. Now we’re rested, refreshed, and ready to deliver a few more lashes.

Two For The Price Of One?

Think the bull market is long in the tooth at almost six years of age? Maybe not.

Major Trend Index (MTI) Goes Negative: Get Defensive

Major Trend Index fell to Negative at beginning of August. Assumption is that we are now in the beginning of a cyclical bear market that may produce a 20%-25% loss within the next six months or so.

The 1974-1982 Template For Recovery

Current market recovery continues to track the post 1974 bear market recovery quite closely.

Revisiting An Analogue For Today’s Market

Current market is closely aligned with the 1973-1974 post bear market recovery. Expect to see series of higher lows before market ultimately makes new high.

November Market Action

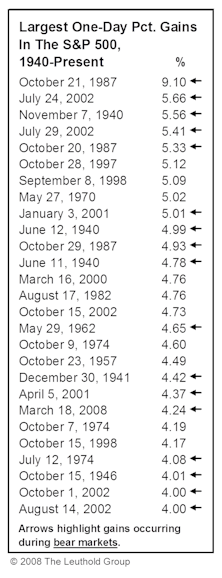

Drama, if not direction, have become one of the stock market’s few certainties.

We're Bullish (And Hoping For “Small” Gains)

Improving cyclical leadership could be signaling that the bear market is in its final stages. In 10 of the 12 past bear markets, cyclical stocks turned up prior to the conclusion of the bear.

December Market Action

Many of the broad market indexes climbed to new cyclical highs in late-December, confirming that 2007 is almost certain to begin with a bull market still in command.

Cyclical Bear Market Profiles

Cyclical bear markets typically decline 25%-30%. In terms of amplitude, the bear market could be more than half over…if it’s a typical bear.

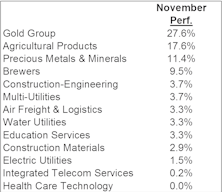

Well…November Was Better Than October

The cyclical bear market appears to be bottoming, but that is only an opinion. Although improved, the Major Trend Index remains negative. Thus, we remain very cautious. We respect the numbers more than our opinion.

View from the North Country

The Outlook - A Summary of Current Views…Faulty Recollection of 1929…A Crash Still Waiting To Happen…December Bottom Fishing Time…Aussie Bonds…The Leuthold Group Eats Some Garlic

Still Down, But Getting Close?

The stock market may be on the verge of 1982’s best buying opportunity, even though for the time being the caution light is on. Early Warning Index and Major Trend Index both Neutral now and 750-780 may be just around the corner, and, a “surprise” financial shock may no longer be a surprise.