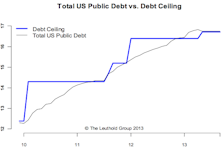

Debt Ceiling

Debt Ceiling—Risk Of An Accident Higher Than Normal

An earlier-than-expected X-date means higher market volatility and increased chance of a temporary short-term deal. Typically, the debt ceiling drama is short-lived and there’s not much impact on most assets before or after a resolution. Overall, the possibility of an accident is now above average.

Goldilocks—Alive And Well

If we look beyond the daily noise from North Korea, the global macro picture still fits our “Goldilocks” view pretty well.

Debt Ceiling—Weakness Before But Strength After Resolution

A look at prior debt ceiling debates and patterns around resolution dates gives no surprises: markets are weaker in the two weeks before but stronger in the month after a resolution is reached.

Lost Confidence In Washington….. But Not U.S. Treasuries

The new deal reached by Congress has little substance and no impact at all until 2014 or beyond. More “kick the can down the road.” Long term debt/deficit issues remain unsolved.