Deflation

Icing Over?

Will this economic cycle end with “fire” (overheating) or “ice” (a whiff of deflation)? Interestingly, hedges against both outcomes have performed well in recent months, with both gold and Treasury bonds spiking. For many reasons, though, we believe the U.S. expansion is more likely to end in a deflationary bust.

Deflation And Deception

We think the current economic cycle is more likely to end in a deflationary bust than with a bout of late-cycle “overheating,” and analysts and investors should recognize that such a cycle ending could be especially difficult to detect.

The Fed Was Not The Only One To Tighten Last Month

Wage inflation should accelerate in the months ahead, oil could bounce from its oversold low, and college textbooks might double in price before the fall semester. No problem…

Stocks Just Delivered A Strong Deflationary Impulse

Investors have just suffered a negative wealth effect that will likely work to tamp down inflation over the next year.

Re-Deflation: Lower Rates, Wider Spreads

Re-deflation is the period where reflation gives way to deflation or disinflation. It has been so prevalent that it triggered a new “Higher Risk” signal in our Risk Aversion Index.

Re-Deflation—RAI Flashes New “Higher Risk” Signal

The re-deflation theme has been so prevalent that it triggered a new “Higher Risk” signal in our Risk Aversion Index. There are significant negative implications for all risky assets.

Deflation…. What If [It Lingers]?

Can a deflationary outlook coincide with a bullish stance on equity markets? The short answer: YES. Periods of more commonly experienced mild deflation have actually coincided with above average stock returns, especially when deflation occurs outside of a recession.

High Correlations And Their Meaning

While our tongue-in-cheek “Correlation Of Everything” measure has retreated from record levels, it remains far above anything seen prior to 2010.

Current Deflation Fears Are Unwarranted

Don’t fear deflation. Leuthold historical studies show mild deflation can actually be a good environment for the stock market.

Deflation To Reflation… Give It Some Time!

Expectations for broad leadership from inflation-beneficiary sectors of Materials and Energy tell us that investor obsession seems to have shifted too rapidly from deflation to “reflation”.

Deflation….What If?

Mild deflation is nothing to fear: An environment of 0% to 2.4% deflation has proven to be one of the more conducive environments for stocks.

Commodity Inflation = OWN MATERIALS STOCKS; Commodity Deflation = OWN MATERIALS STOCKS!!

There remains considerable macro support for industrial commodities.

View From The North Country

Steve Leuthold answers client questions in this month’s “View From The North Country”, including his thoughts on the slowing earnings growth, and his definition of secular bear markets. His dollar outlook is also updated.

Deflation: Not Likely, But, “What If?”

We think deflation fears are overblown, but, it isn’t necessarily bad for stock performance.

View From The North Country

Why deflation and depression are not synonymous, undemocratic suggestions for 401(k) plans and the NBA Name Game: Does Basketball’s sponsorship fare better than baseball or football?

What Is The Year End Flat Yield Curve Telling Us?

The U.S. yield curve could mildly invert in 1998, even with a passive Fed.

What Is Flat Yield Curve Telling Us?

Long term rates are "normally" higher than short term rates to compensate investors for the likely risk that inflation will undermine the value of their bonds.

View From the North Country

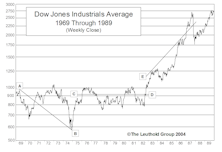

Is Warren Buffett doing some very significant selling? I think this might be the case. Leuthold Group three part series on deflation will be sent to clients in September and October. Also, the 10th Anniversary of 1987’s stock market peak: two important “then” and “now” comparisons.

Bond Market Summary

Bond market rally continues: weaker economic news, lethargic consumer spending, and tame inflation reports increase likelihood of further Fed easing. Other positives include strong foreign buying, and improving fiscal disciplines.

Inflation/Deflation and the Stock Market

What Has Been The Best Inflationary Environment For Stock Market Performance?...How Have Stocks Done In Deflationary Years?...121 Years Of History Examined...Also Looks At P/E Ratios In Different Inflationary Environments

Inflation, Deflation and Stock Prices…Update

In examining various consumer and producer price measures going back for as long as 1000 years, it was found that prices have risen about 60% of the time and fallen about 40% of the time in the Western world.

U.S. Inflation History

A preview of our new U.S. inflation histograms, soon to be regular features of our quarterly Benchmarks publication.

Inflation/Deflation and the Stock Market

Today, many are concerned about the potential negative impact of deflation and the stock market. Our work demonstrates that moderate deflation has typically not been a hostile stock market environment. However, deep deflation (5%-11%) has historically been a bad time for stocks.

Inflation Watch…..Still Cool

Regardless of the recent reported upticks in the GNP Deflator and CPI, our Early Warning Inflation work provides little if any evidence that inflation is beginning to accelerate. Five of our inflation analytical tools are presented and discussed, along with the risks of Deflation.

All’s Quiet on the Inflation Front (Now What About Deflation?)

At this point there is no indication inflation may be about to accelerate. Some may recall that in the early spring of 1984, this work led us to conclude that 1984 inflation might be a lot lower than most then thought at the time. This section also includes comments on the possibilities of deflation and what might be expected if it does occur. It probably would not be the disaster some seem to think.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

![Deflation…. What If [It Lingers]?](https://cdn.leutholdgroup.com/leutholdgroup.com/site_files/field/image/2015-march-special-interest-asset-1.jpg?fit=fillmax&w=222&bg=FFFFFF)