Developed Markets

No Place Like Home For The 2010s

We thought we’d get a jump on all the “End of the 2010s” retrospectives you’re sure to see next month. Though not quite yet the official end of the decade, the changing of the “tens” digit definitely has a certain gravitas to it.

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

Momentum-Based Country Rotation: EM Vs. DM

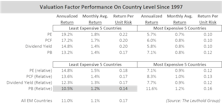

Last month we assessed the effectiveness of using valuation factors as a basis for country allocation. Using 20 years of data, our results showed that they work quite well specifically for Emerging Market (EM) country-rotation, however, the same valuation-based strategy does not appear to be value-added for Developed Market (DM) allocation/rotation.

Valuation-Based Country Rotation: EM Vs. DM

Many studies have evaluated momentum factors for over/underweighting country exposures within a portfolio, but few have considered valuation factors for country rotation within the Emerging Market space.

Can The EM Problem Spread To DM? Yes, If It Gets Bad Enough

The current EM weakness is not yet a full-blown crisis but, if it does become one, it will drag down developed economies too.

"Muddle Through"

The global economy is stuck in a “muddle through” mode with developed and emerging countries showing divergence in terms of leading indicators. Despite this divergence, they share one thing in common: an upturn in inflation. How much more room there is for easing is a key determinant of asset market performance.

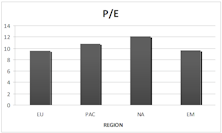

Where To Invest? A Graphical View of Global Equity Markets

Taking into account the variety of total return contributors, we conclude that no one regional equity market stands out as a slam dunk investment idea.

The Sector Effect Vs. The Regional Effect

Focus of global investing has shifted from sector and is now centered on the regional effect.

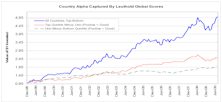

Country Alpha From Global Group Scores? You Better Believe It!

When clients ask about our country views, we suggest they take a look at our global group work because our Global Group Scores are capable of capturing country alpha!