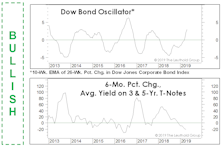

Dow Bond Oscillator

Something BAA-d Brewing?

Tightening peaked in Q4-2022, with the BAA yield at 266 bps above its year-earlier level—the most contractionary move since the early 1980s. If the standard lead-time applies, the full impact will be felt in Q4-2023.

Was That A Pivot?

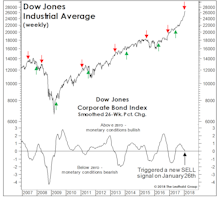

Stock market monetary- and liquidity conditions over the last year have been the harshest we’ve seen in a 33-year career, and consistently the largest drag on the Major Trend Index (even overshadowing valuations!).

Let Us Add To The Bullish Cacophony

It’s been a heck of a stock market year, and there are still four months left. What else could go right? Monetary conditions, for one thing—at least as proxied by our Dow Bond Oscillator (DBO).

More On The “Rate-of-Change” In Rates…

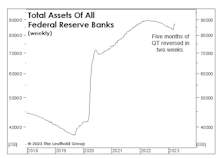

The liquidity and interest-rate backdrop for stocks has been favorable to such an extreme that we’ve cautioned any minor diminution in this condition could trip up the stock market. On that score, the monetary aggregates and the Fed’s balance sheet don’t pose much concern. On the other hand...

Has Liquidity Peaked?

The last few weeks offer plenty of evidence that the mania has moved into a more feverish phase, yet the Fed insists that it is still “not-even-thinking-about ‘thinking about’” raising interest rates. That dismissive attitude could well whip up an even higher fever in the months ahead.

Monetary Madness

We always do our own work and draw our own conclusions. Lately, though, we’ve wondered what the late “Monetary Marty” Zweig might say about the stock market’s current liquidity backdrop.

Deflation And Deception

We think the current economic cycle is more likely to end in a deflationary bust than with a bout of late-cycle “overheating,” and analysts and investors should recognize that such a cycle ending could be especially difficult to detect.

Mixed Monetary Messages

Confidence in the U.S. economy’s health reached a new peak with the April employment report, with a blowout number for nonfarm payroll coinciding with a soft wage print.

About That Great Jobs Report...

The December employment report temporarily eased fears of a severe U.S. slowdown. That’s a mystery to us.

Foreign Stocks “De-Coupling”

Market action has been broader and better than we expected given monetary conditions, and Small Cap strength seems to lend credence to contention that rates aren’t yet high enough to bite.

Breadth Is Great— Except Where It Matters The Most

Last week’s piece challenged the now popular view that new highs for the Russell 2000 are a decisively bullish factor for the stock market in the near term. To our surprise, we found that market returns during periods of well-defined Small Cap leadership are significantly lower than when Smalls are laggards.

Should Bond Bears Barbell?

The deterioration in stock market liquidity remains at the forefront of our concerns and is a key reason that the Major Trend Index is hovering just above its bearish threshold of 0.95...

Market Pressure Points?

Last month we detailed a handful of economic and monetary measures that were approaching critical thresholds from a stock market perspective.

Rates: Does Trend Or Level Matter More?

Our Dow Bond Oscillator (chart) issued what looks like an increasingly prescient SELL signal on January 26th.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)