EBIT

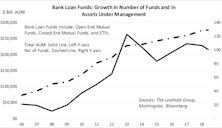

Bank Loan CEFs: Double Leverage Implies Higher Risk

In prior publications we’ve written about corporate leverage, which has risen to an alarming level, and we’re concerned that this could be a trigger for the next market downturn.

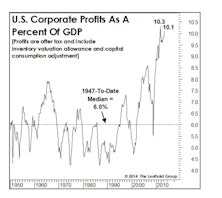

Margins Prove Capitalism Still Works

Corporate profits were outstanding last year, but even the benefit of a 40% cut in the top income-tax rate wasn’t enough to lift the net profit margin back to the all-time high of 10.6% established in early 2012. Still, the latest 10.0% figure is more than a percentage point above the 2007 cycle high and about two points better than any other cycle high.

What Can Margins Do For An Encore?

A massive drop in corporate tax payments lifted the third quarter NIPA profit margin back to the 10% level for the first time four years. But while we try not to always view the glass as half empty, we find it troubling that margins remain well-below their 2012 highs (10.6%) in spite of this one-time windfall.

Margins: Mean-Reversion Works

A late March issue of The Economist proclaimed “profits are too high” and “America needs a giant dose of competition.” Funny. NIPA Corporate Profits figures released that week show The Economist’s plea for lower profits had already been fulfilled—and not just in the latest quarter.

Margins: Reversion Can Be Mean

In Q2, NIPA’s EBIT margin fell to a new four-year low, over one point below the early 2012 cycle peak.

Corporate Profits In 2014

Earnings growth over the next few years will—in the best case—be forced down to the rate of top-line growth (nominal GDP).

The Mundane Truth Behind Margins

The margin expansion story of the last 20 years is a financial one, not an operating one.

Decomposing Today’s Record Profit Margins

The celebrated gains in corporate profitability over the past decade and a half are attributable primarily to proportional declines in “below the line” items like interest expense and corporate taxes.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)