Emerging Markets

Emerging Markets: Watching Closely

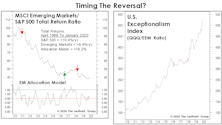

Foreign stocks have been leaders off last fall’s lows, but not by a big enough margin to flip our Emerging Market Allocation Model to a bullish stance. The model factored into our general avoidance of EM equities the last several years; now January’s action has us on alert that the outlook may soon shift.

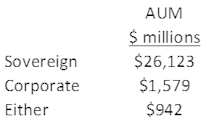

The World Of Emerging Market Bonds

Investors looking to diversify away from the U.S. interest rate environment and/or the domestic business cycle may wish to consider Emerging Market bonds, an asset class with lower correlations to the U.S. Agg. Bond Index. EM bond investors can choose between several investment attributes to find the risk / return profile with which they are most comfortable. This study surveys the investment tradeoffs offered by each sub-category, as defined by ETFs focused on each particular asset class.

Research Preview: Emerging Market Bonds

The U.S. Aggregate Bond Index lost 3.8% in April, bringing its year-to-date return to an agonizing -9.5%. The realization that bonds can lose big money, combined with the outlook for stubbornly high inflation and continued rate increases, is nudging bond investors to consider a wider scope of alternatives.

Emerging Markets EPS: There's Many A Slip...

If there is one thing sure to make equity investors swoon, it is the prospect of buying into a credible, long-lived secular growth story at a relatively modest valuation. Over the past three decades, Emerging Markets (EM) have proffered just such an opportunity. EM’s economic growth rates have far surpassed those of developed nations, and the valuations attached to EM stocks have often been at a discount to other markets.

However, this combination of secular growth and attractive valuations has not always paid off for investors. The MSCI Index has underperformed the U.S., Europe, and even Japan over the last ten years in local currencies. Furthermore, EPS growth for the EM Index has come in far below its economic growth rate, creating an exasperating drag on Index performance as it tries to keep up with other regions.

Research Preview: Emerging Markets’ Leaky Bucket

Investors view Emerging Markets (EM) as the best source of economic growth across global equity markets, and rightly so. Annualized EM GDP growth of 8.6% since 2001 is more than double that of the U.S. and Europe. However, investors have not captured this extraordinary advance because earnings per share for the MSCI EM Index have lagged far behind EM economic growth rates.

A Lost Decade For Emerging Markets

Fading momentum in GDP growth, sizable dislocation of corporate EPS in the midst of an expansion, and U.S.-dollar weakness have all made EM equity investments inferior to U.S. stocks over the last decade.

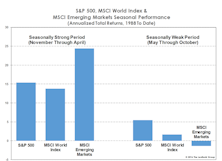

Small Cap Synchronicity

Small cap stocks are often seen as a bullish, risk-on, pro-cyclical asset class. They benefit from economic growth, rising inflation, widening margins, and the willingness of investors to move out on the risk spectrum. The pandemic recovery has created these very conditions, and small caps responded right on cue by posting a blockbuster price gain of 130% since the COVID-19 bear market low of March 23, 2020. Because the pandemic was a global economic and health care catastrophe, we were curious to see if small caps behaved similarly in other regions.

Research Preview: Global Small Caps

U.S. small caps have posted blockbuster price gains coming off the pandemic bear-market low in March 2020. We were curious to see how international small caps have performed since then, and launched this project to learn how this asset class has recently behaved in other regions.

EAFE And EM: Long Past Their “Peaks?”

We applied the “Peak Cash Flow” valuation methodology to the EAFE and MSCI Emerging Markets Index and found them both priced at only about one-half of today’s MSCI U.S. multiple. However, the ratios are already above anything achieved during the 2009-2020 global bull market.

Triggered!?

In recent months, we’ve highlighted some reasons to buy or add to Emerging Market equities, and at year-end received a formal endorsement from our monthly Emerging Market Allocation Model. The signal triggered after a 30-month period in which the model recommended the relative “safety” of the S&P 500—in retrospect, a good call.

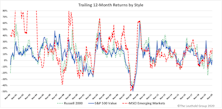

Style Rotation: Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

Time For EM Stocks?

On the basis of both Normalized P/E and Price/Book, there’s plenty of runway for EM stocks if they get back to even the midpoint of their 20-year valuation range. Rising commodity prices and a weak dollar would obviously help, and we expect both in the year ahead.

VLT’s Struggles Are Telling Us Something

Our Very Long Term (VLT) Momentum algorithm has been a very good “confirmatory” market tool over the years, especially at the onset of a new cyclical bull market. But VLT has proven to be of little to no value in navigating this year’s gyrations. VLT’s latest flip-flops reinforce our view that the market leaderboard is set to be rearranged.

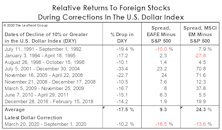

Foreign Stocks Party Like It’s The “2010s”

The most likely catalysts for improved relative performance of foreign stocks would be: (1) a bear market; (2) a recession; and, (3) a major downturn in the U.S. dollar. This year has supplied all three, yet the relative strength ratios of most foreign equity composites continue to grind lower as if it’s “business as usual.”

“Guess What’s Been Exceptional?”

How can an equity manager possibly keep up with the QQQ—an ETF that’s almost 50% invested in the six largest U.S. companies?

Easy! Own the vehicle that benefits the most from a collapse in global trade volume and an escalating cold war between the U.S. and China—the EEM (iShares MSCI Emerging Markets ETF)!

Enhancing Country Rotation With Sector Concentrations

A dramatic shift of country weights within EM indexes has become an inadvertent challenge for a country rotation strategy. Due to this, we tested the integration of a momentum-based sector rotation model to attain exposure to the top-rated sectors to represent the markets of the largest country components instead of seeking to obtain “whole market” exposure.

EM Equity Purgatory

Nine months ago we established a “pilot” position of 4% in Emerging Market equities in the Leuthold Core Fund, based mostly on the bullish inflection in a long-term technical indicator (VLT Momentum).

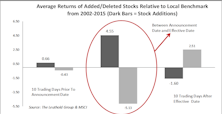

Index Rebalance Effect—A Disappearing Anomaly?

In the past we’ve made the observation that adding/deleting stocks to/from a popular index can have a profound impact on the target stocks’ short-term trading volume and performance.

No Place Like Home For The 2010s

We thought we’d get a jump on all the “End of the 2010s” retrospectives you’re sure to see next month. Though not quite yet the official end of the decade, the changing of the “tens” digit definitely has a certain gravitas to it.

Jury Is Still Out On EM

Emerging Market stocks have been swept up in the last month’s rally in all things cyclical and high beta. Nonetheless, the MSCI Emerging Markets Index is still down marginally from its level coinciding with its April 30th VLT BUY signal.

Odds & Ends

Here are some brief follow-up notes on topics covered in recent months’ Green Books.

Adding EM On A Rent-To-Own Basis

The Major Trend Index has remained in neutral territory during the last several weeks of upside action, suggesting there remain significant fundamental and technical shortcomings beneath it all. But this precarious MTI stance didn’t preclude us from acting on a new bullish reading for Emerging Market equities at the end of April.

Adding Some Emerging Markets On A “Rent-to-Own” Basis

Emerging Market equities have been modest underperformers during the current rally, but they’ve marshaled enough strength to trigger a new low-risk BUY signal on our VLT Momentum algorithm at the end of April.

The Emerging Markets Dilemma

We’ve been either light on Emerging Market stocks or out of them altogether since early 2011, but have lately been watching for an opportune time to re-enter.

Emerging Markets: Not Persevering, Just “Preserving”

We’ll never know how world events might have evolved had Mitt Romney won the presidential election in 2012. But thanks to the wonderment of Emerging Markets’ underperformance, we can go right back to the last days preceding that fateful election.

Narrow Performance Divergence Among EM May Not Last

We’ve previously noted the narrowing performance divergence between top- and bottom-performing Emerging Market (EM) countries in recent years.

Emerging Markets: Down A Lot, But Not Really Cheap

The stock market liquidity squeeze we’ve discussed this year hasn’t played out quite like we expected. Traditionally, Fed tightening and slowing money growth hit Small Caps earlier, and harder, than the blue chip stocks...

EM Country Rotation Based On A Stock Factor Model

Back testing shows stock-level factor alpha can be captured at the country level. With the rapid growth of single-country ETFs, this may prove an efficient, practical alternative to individual stock selection.

Economic Performance: Powerful Factor For Country Rotation

In previous studies, we looked at two classic factors for employing a country rotation strategy: valuation and momentum.

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

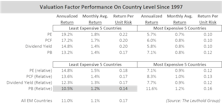

Valuation-Based Country Selection/Rotation

Despite cyclicality, over the longer term, investing in lower valuation countries ekes out better performance in an EM portfolio, and Dividend Yield showed the most consistency in terms of value factor effectiveness.

Momentum-Based Country Rotation: EM Vs. DM

Last month we assessed the effectiveness of using valuation factors as a basis for country allocation. Using 20 years of data, our results showed that they work quite well specifically for Emerging Market (EM) country-rotation, however, the same valuation-based strategy does not appear to be value-added for Developed Market (DM) allocation/rotation.

Valuation-Based Country Rotation: EM Vs. DM

Many studies have evaluated momentum factors for over/underweighting country exposures within a portfolio, but few have considered valuation factors for country rotation within the Emerging Market space.

Emerging Markets: Fundamental Diffusion Indicators

Within EM, more robust growth is being exhibited by: 1) firms in Emerging Europe; 2) companies in Energy, Materials, and Financials; and, 3) larger cap companies.

Emerging Markets: Momentum-Based Sector Rotation

Momentum factors are effective in differentiating EM sector performance, with High Momentum significantly outperforming Low Momentum. Unfortunately, there is a lack of investable EM sector vehicles.

EM: The Case For Waiting...

We’ve mentioned that concerns over potential seasonal weakness in September and October seem pronounced this year, perhaps because the year has so far turned out a pleasant surprise following its horrendous start.

EM Leadership: Just The Beginning?

Our EM Allocation Model triggered a BUY at the end of August after 5 1/2-years in bear mode. This upgrade is consistent with a cyclical leadership run of one to four years relative to Developed Markets.

From Turkey To Thailand, EM Political Risks Hard To Dodge

A military coup was staged in Turkey on Friday, July 15th, but it was quickly suppressed. The damage, however, was done.

EM: Improved Sentiment But Macro Risks Still Dominate

Positive forces may be transient. Be wary of EM’s high correlation to commodities and Chinese stocks.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)