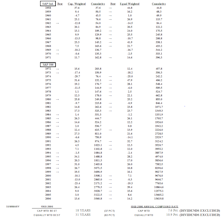

Equal Weighted

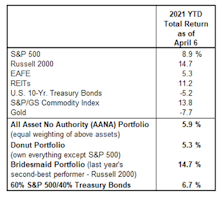

Time For A “Donut” Break?

Despite a resurgence in Small Cap stocks and Commodities, it still feels like an “S&P 500 World” for asset allocators. The financial media remain obsessed with S&P 500 targets, S&P 500 earnings, and S&P 500 stocks. And why wouldn’t they be?

Research Preview: A Surprising Dividend Study

Dividends are a cornerstone of equity investing and, over the decades, they have produced a significant portion of the stock market’s total return. Previous Leuthold research has identified a strong dividend influence on total returns for small and mid-caps; a client recently asked if we found the same effect in the universe of S&P 500 companies. Specifically, have S&P 500 dividend-payers outperformed non-payers, and, second, have dividend growers outperformed non-growers?

A “May Day” Revolution?

With May Day marches and demonstrations cancelled, the workers of the world have one less opportunity to remind us of the ever-widening wealth gap and the evils of the “Top 1%.” It’s a shame, because this was the year that we active managers would have stood shoulder to shoulder with those protesters voicing our own contempt for the “Top 1%”… of the S&P 500.

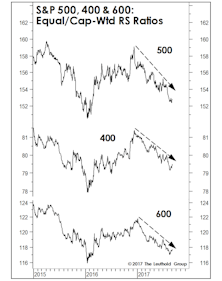

Seasonality And Market Breadth

While the FANGs—and, lately, the Dow stocks—are the market’s undisputed leaders, it’s difficult to argue the market has narrowed in a fashion that’s indicative of a “distribution” phase.

Market Breadth Has Yet To “Lie” Down

We shouldn’t bite the hand that feeds us, but it’s easy to lie with charts.

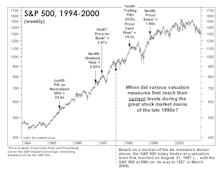

The Valuation “Time Clock” Revisited

Based on a median of six measures, today’s S&P 500 valuation profile equates to the one prevailing on August 31, 1997. From there, the S&P 500 rallied >60% over the next 2 1/2 years before peaking. However, the same can’t be said of valuation readings for the “typical” or median stock.

Additional Factors

September was very unkind to smaller firms.

Additional Factors

The S&P 500 couldn’t hang on to its gains and snapped a five month winning streak in July. This is only the third down month in the last year.

Additional Factors

As the market found a new leg higher the last two weeks of May, the Cap Weighted and Equal Weighted S&P 500 Indexes had uniform advances—just over 2% for the month. The Equal Weighted Index maintains an 80 bps lead YTD.

Additional Factors

Market Cap has been slightly better than equal the past two months.

S&P 500 Equal Weight

Cap Weighted Slightly Better In Flat Performance Month.

S&P 500: Equal Weighted Index Slightly Better in January

The Equal Weighted Index has outperformed the Cap Weighted Index in seven of the last nine months.

S&P 500: Equal Weighted Index Better in 2013

For 2013, the Equal Weighted Index bested the Cap Weighted Index by 4%. The Equal Weighted Index has outperformed the Cap Weighted Index in four of the past five years.

S&P 500: Cap Weighted Outperforms For The Second Month In A Row

During November the Cap Weighted S&P 500 (+2.8%) outperformed the S&P 500 Equal Weighted (+2.1%) for a second consecutive month.

S&P 500: Cap Weighted Outperforms During October

The Cap Weighted S&P 500 (+4.5%) slightly outperformed the S&P 500 Equal Weighted (+4.2%) during October. YTD, the spread between these two indices remains wide, with the Equal Weighted index outperforming by 4.2%.

S&P 500: Equal Weighted Outperforms In Q3; Maintains Lead YTD

On a YTD basis, the spread between these two indices continues to expand, with the Equal Weighted index now outperforming by more than 4%. Consumer Staples is the most expensive sector among Large and Mid Caps, while Health Care is most expensive in Small Caps.

S&P 500: Equal Weighted Outperforms During July

The Equal Weighted S&P 500 (+5.4%) outperformed the Cap Weighted S&P 500 (+4.9%) and also continues to outperform on a YTD basis.

Weighted Versus Unweighted: Inside The S&P 500

In 2006, the capitalization weighted S&P 500 was up 13.6%, excluding dividends. The average return for the 500 stocks (S&P equally weighted) was up 14.2%.

Answering Client Questions

Many of the questions in this month’s issue came from January client meetings in Texas.

Large Cap Versus Small Cap: Inside The S&P 500

Poor performance by Large cap technology issues had a very negative impact on S&P 500 cap weighted performers in 2000.

Tracking Shifts In Market Capitalization Leadership

If small caps can move back above the October 1999 level in the coming months, this would certainly be encouraging for small cap fans and may even signal a change in the trend to confirm that leadership is indeed moving to the small cap arena.

Will Active Management Ever Beat the S&P 500?

It will happen again! Relative overweights in small caps will be an advantage instead of disadvantage to portfolio managers. Small caps can grow earnings faster.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)