Fed

The Fed Should Pause And It Will

Liquidity reduction (QT) by global central banks is already showing up in slower M1 growth in all G3 countries. Slower M1 growth has led economic slowdown by about twelve months.

Three Steps And No Stumble

Given the high likelihood of a March rate hike, we can’t help but wonder if the old adage of “three steps and a stumble” really holds.

Market’s Message To The Fed: Stop The Tightening!

We think the Fed’s projection of four more hikes this year is absolutely unachievable, and we are no doubt siding with the market’s current projection of one hike, at most (if any), this year.

Impact Of The First Hike - This Time Might Really Be Different

At this point, the worst outcome for the risk markets would be no hike in December.

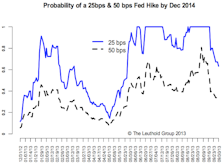

A December Hike Likely

Our interpretation of the current Fed stance is that it has shifted from “hike if the data and the market support” to “hike unless the data and the market perform poorly.”

Twisty Curves

The short end of the yield curve sold-off to price in an earlier-than-expected rate hike, while the long end rallied as the prospect of tightening reduced longer-term inflation expectations.

Consumer Discretionary: End Of The Run?

Last month we suggested the top sector for 2013 would fall from grace in 2014, and the Consumer Discretionary stocks have been quick to cooperate in the last five weeks.

U.S. 10-Year: 245-250 Area A Strong Barrier

We expect the 245-250 area, the upper bound of the previous lower range, to be a strong barrier.

A Taper & Hibernating Bears

The rise in interest rates after the taper was on the back of low liquidity around the holidays. 3% is a pretty strong upper bound for the 10-year, and a failure to stay above this level will probably see a re- test of the 275 level in the near term.

10-Year: No December Taper, Back To The 250 Level

Given our assumption of no December taper and the fact that most of the recent rise in interest rates is due to an early-taper fear, we expect the 10-year yield to drop back to the 250 level.

The Dual Mandate Presents A Clear Dilemma For The Fed

The “dual mandate,” which means the Fed is paying close attention to both inflation and employment, presents a clear dilemma for the Fed when it comes time to decide on a taper.

10-Year: Year-End Target Still 250 BPS, Interim Volatility Expected

We don’t think the numbers between now and the Fed’s December meeting will be strong enough to convince it to start tapering this year. No taper until 2014, in our opinion.

No Taper—More Downside Likely On The 10-Year & Higher Volatility Ahead

A look at prior debt ceiling debates and patterns around resolution dates gives no surprises: markets are weaker in the two weeks before but stronger in the month after a resolution is reached.

It Doesn’t Get To Look Any Better

Ben Bernanke seems at peace with his looming retirement from the Fed. He’s certainly more relaxed and confident, and even looks more youthful. So much so, in fact, that Ben’s last appearance had me thinking of a young Tom Cruise - or more specifically, Cruise’s character Pete Mitchell (“Maverick”) in the 1986 film Top Gun. Remember when Maverick froze up during a dogfight with a Soviet MiG fighter, with his crosshairs trained perfectly on it?

Maverick: “Uh, it’s not good. It doesn’t look good.”

Data Dependency—September Taper Still Likely

More upside surprises are still likely and, despite the disappointing jobs report, the overall economic picture still supports a September taper. The improving economic picture is not just happening within the U.S., but in other major countries. We still believe the upside for the U.S. 10-year is limited.

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.

The Fed: The First Hundred Years

If you think being “sequestered” or “Cyprussed” is no fun, turn the calendar back a century. 1913 saw the authorization of the Federal Reserve System and the ratification of the income tax amendment to the Constitution. (CNBC’s Rick Santelli would have been apoplectic.)

Presidential Elections And Financial Assets

Does The Market Have A Party Preference In The Presidential Election? Results are a wash, so investors might rethink their assumptions about party affiliation and market performance.

Demise Of Corporate Tax Revenues? A Look At Trends Of Corporate Tax Vs. Individual

This month’s “Of Special Interest” examines Federal tax revenues from corporations versus individuals. Despite strong revenue and earnings growth, corporations paid fewer taxes this year; all of the government’s revenue increase came from individuals.