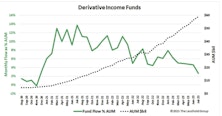

Fund Flow

Reditus Emptor Caveat

Despite skyrocketing investor enthusiasm, buy-write strategies are complicated investments with skewed payoff structures that muddle the interpretation of past performance, because returns depend on market conditions.

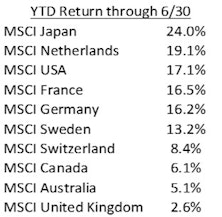

Land Of The Rising Stock

After years of wandering in the wilderness, Japanese stocks are leading the world’s developed markets higher in what has been a robust opening half of the year. The table shows Japan leading the world’s ten largest developed markets (as measured by the MSCI family of international indexes) with a 24% local currency return through June, easily outpacing the pack. Even as the MSCI USA index gained 17% by successfully “fighting the Fed” this year, Japan surged another 7% beyond that outstanding result. We were curious to understand the nature of Japan’s spectacular run in 2023, looking to identify the drivers of this strong and relatively quick jump higher.

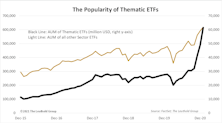

ETFs Evolving: Make Mine Mint Chip

The ETF concept began as a vehicle to provide low-cost access to a broad market index, and the terms “passive”, “cheap”, “index”, and “ETF” were often used synonymously. However, ETFs soon evolved into specialty funds that allowed investors to take focused active tilts in sectors, styles, and countries; a landmark shift away from the notion of passively investing in the total market. These specialty funds are easy to trade and tax efficient, but they do not fall under the labels of cheap, passive, or broad market.

Newfound Popularity Of Thematic ETFs

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly-defined business enterprises outside of the standardized GICS methodology.

Carbuncles, Diamonds, and Tears

High growth rates, innovation, and disruption are defining traits of the companies that have powered the market to recent highs, and the ARK Innovators Fund (ARKK) is an example of today’s enthusiasm for visionary growth stocks. Recent returns and growth in AUM have been nothing short of spectacular, and ARKK has become symbolic of today’s style of new-era growth investing.

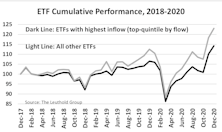

The Relationship Between ETF Fund Flow & Future Returns

In April 2018, armed with a large number of ETFs and long-enough historical data, we applied our back-testing methodology for individual stocks to the universe of ETFs to determine if the same (or some) of those components could useful for assessing ETF performance prospects. One of the factors we reviewed was fund flow (adjusted by AUM), which revealed that those ETFs experiencing the largest asset inflows proceeded to significantly underperform.

The “Pfizer Factor Flip” And Fund Flows

Pfizer’s November 9th announcement of an effective COVID-19 vaccine triggered the most extensive one-day rotation in style factors we have ever seen. Investors flipped from Large Growth—the market’s dominating style over the past few years—and found new friends in Value and Small Cap. This rotation continued through November, to the point that Value and Small Cap each had their best single-month return in 30 years.

Five Reasons To Expect Higher Yields

Much of what we think “we know” about the bond market says yields should be headed higher.

Shun ETFs With Largest Inflows

We found that ETFs with the largest one-month, two-month, and three-month fund inflows underperformed going forward. When further broken down by sub-asset class strategies, this pattern is pronounced among equity ETFs, while fixed income ETFs do not appear to be affected by fund flows.

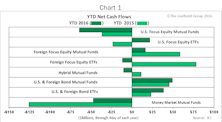

Stock/Bond Market Fund Flow Trends

Bond funds (including ETFs), foreign-focused equity mutual funds and domestic-focused ETFs are the only categories capturing positive cash flows YTD.

Cash Left The Sidelines Long Ago

The “cash on the sidelines” is a Supply/Demand argument that we’ve struggled with even in the most bullish of times; every purchase of a security is matched with a sale. But even taking the argument at face value, current holdings of retail investors and mutual fund managers suggest that the cash left the sidelines long ago.

Domestic Equity Mutual Funds and Bond ETFs See Weekly Net Outflows.

Within two broad categories – domestic equity funds and bond funds - mutual funds versus ETFs continue to display opposite flow trends.

YTD Bond Mutual Fund Flows Top 2013 Comparator

Bond mutual funds continue to capture net inflows while their ETF counterparts have seen net outflows for three straight weeks. Domestic equity mutual funds see more net outflows, but (barely) hang on to positive YTD flows.

Bond ETF Net Outflows Accelerate

Bond ETFs, Domestic Equity Mutual Funds and Money Market Funds see weekly net outflows, while all other broad categories experience net inflows.

Domestic Equity MF Flow YTD Highest Since 2006

Aside from money market funds, cash flowed on a net positive basis to all broad fund categories this week. Domestic equity mutual funds saw an estimated $1.2 billion in net inflows, on the heels of two weeks of outflows.

Outflows From Equity & Bond Funds

Outflows From Domestic Equity & Bond Funds Continue; Foreign-Focus Funds Still See Inflows.

Second Week of Equity Fund Outflows

Net cash outflows from bond mutual funds are not letting up; we've seen fund outflows in 25 of the past 27 weeks, with this week's estimated net outflow at $5.6 billion.

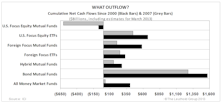

2013’s Fund Flow Trends Have Room To Run

Year-to-date, equity funds are cash on par with those of the 2000 tech bubble, while bond mutual funds are experiencing net cash outflows for the first time in a decade.

Target Date Funds Impacting Industry Fund Flows

Funds of funds, particularly target date funds, are growing rapidly and are now large enough to have a measurable impact on underlying fund flow trends.

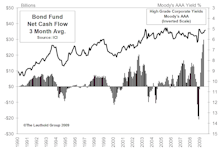

Strongest Net Outflows From Bond Funds In Years

Most noteworthy this week was a combined estimated $13.5 billion exiting bond mutual funds and ETFs on a net basis.

Record Breaking YTD Fund Flows In 2013

While flows into the largest mutual fund category by assets have petered out in recent months, a number of impressive fund flow trends quietly remain intact.

Fund Flows Still Not Quite As They Appear

In this report we take an in-depth look at the evolution of the industry, particularly the U.S. mutual fund industry, to help understand how some fund flow trends are more of an indication of evolving investor preferences instead of an indication of retail investor sentiment toward a particular asset class.

New Highs, And Then What?

We are in clear view of the “Twin Peaks” S&P 500 highs of the last decade and these should be eclipsed by mid-year. But when the S&P 500 is adjusted for inflation or denominated in Swiss Francs or Gold these highs may prove elusive.

An Update On Fund Cash Flows In 2013

The late 1970’s bull market has some eerie similarities, and sentiment reflects Main Street’s newfound bullishness. Plus a look at January fund category flows gives us some points to ponder.

Fund Flows Not Quite As They Appear

Despite flows out of U.S. focus equity mutual funds, investors remain heavily invested there; while dollars flood into bond funds, they’re also flowing into other varieties of equity funds.

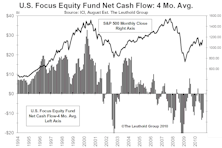

Will Public Buying "Drive" New Market Highs?

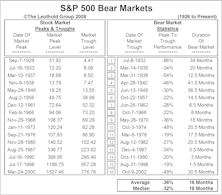

U.S. focused equity mutual funds see continued net outflows. A look back at mutual fund flows during past bull markets answers whether public participation is required to reach new stock market highs….And does a bigger Bear market equate to a bigger Bull market recovery?

Mutual Fund Outflow Played Significant Role In MTI Deterioration

Mutual fund outflow played significant role in Major Trend deterioration. There have been about 6 1/2 months where the four week average has shown net inflow to U.S. equity funds, but outflow is now accelerating as three of last four weeks have seen net outflow.

Emerging Market Indicators Study—Emerging Market Fund Flow

Jun Zhu examines the use of Emerging Market Mutual Fund Flow as a sentiment indicator. It works best as a buy signal, but is not bad as a sell signal. Currently neither on a buy or sell.

The Charts Of The Year

This month’s “Of Special Interest” takes a look back at and updates some our favorite charts from 2010.

Nightmare On Main Street: Individuals Are About To Get It Wrong…Again

There were plenty of interesting facts to be discovered in reading the latest mutual fund flows report from the Investment Company Institute (ICI). The recently released report, which detailed the statistics for September, showed that there were nearly $15 billion of net redemptions from U.S. equity funds for the month. September, by the way, was a month where the S&P 500 rallied to an 8.8% gain. We have noted in the past that the public is generally a trend following herd that buys into market strength and sells on weakness.

Basics For Fund Flow Trackers...And Exceptions To The Two Golden Rules

The relationship between equity mutual fund cash flow and performance of the equity markets can be reduced to two basic “golden rules” of interpretation.

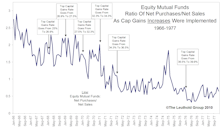

Stock Market Reactions In Rising Tax Environment

Taxes are slated to go up as Bush tax cuts expire. History shows that selling increases in anticipation of higher capital gains taxes. Stock performance also does better in anticipation of lower tax environments than higher.

An Open (Yet Purely Theoretical) Letter To Individual Investors

When you are all doing the same thing at the same time, it’s usually a good time to question if the investment makes sense anymore.

Equity Fund Flow Trends In 2009… Emerging Markets Is Where It’s At

In 2009, Main Street investors continued to pull money out of U.S. focus equity mutual funds. There were some equity funds that they did embrace…specifically Emerging Country funds.

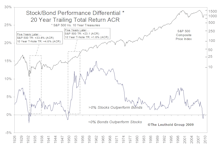

Lemmings Atop The Fixed Income Cliff....And How This Could Play Out Well For Equities

Get out in front of the lemmings. We expect to ultimately see bond funds reverse now that performance has been lagging the stock market. But where will the money go? Our best guess is that it flows to Emerging Country Equities….once again chasing strong performance.

Six Important Trends From The Supply/Demand Front

This month’s “Of Special Interest” section looks at six trends from the Supply/Demand front. Key to several of these trends is that investors chase performance: still seeing big inflows into bond funds, with big outflows from retail money market funds.

Mutual Fund Flow Trends...Some Encouraging, Some Troubling....

Starting to see some modest inflow into U.S. focus equity mutual funds, which is a stock market positive.

October Capitulation

There was $84 billion coming out of U.S. stock and bond funds in October, the highest net redemptions ever. Second highest month of outflow came in September 2008 (just a month earlier). To us, this looks like a case of capitulation by the public.

The Beginning Of The End.....Yes, We’re Talking About The Bear Market

September was a horrible month for the stock market, but now is not the time to be selling stocks. We believe a market bottom is close at hand, and this month’s “Inside The Stock Market” section presents several of our “big picture”, historical market studies to provide support for this belief.

NASDAQ Ten Year ACR Now At An All-Time Low...And Heading Lower

Demoralizing long term returns factor into why the investing public has avoided the U.S. stock market during the last several years — even during the bull market.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)