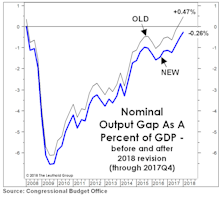

GDP Output Gap

CBO: The Ministry Of Misinformation?

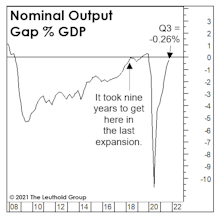

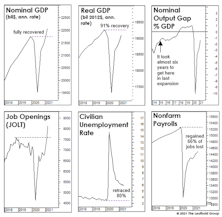

After failing to publish an estimate for the GDP Output Gap for nine months, the Congressional Budget Office has just decreed that the economy has yet to reach its full-employment potential!

“Gapping” Lower?

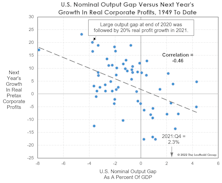

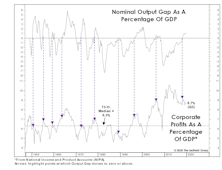

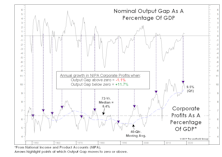

NIPA’s “all-economy” profit margin declined a bit in Q4—which typically peaks before SPX profits—and that falloff coincided with the economy officially reaching full employment, based on the CBO’s Nominal GDP Output Gap. When the Output Gap has flipped positive (like in Q4), corporate profit margins usually come under immediate pressure.

Inflation: More Lighter Fluid!

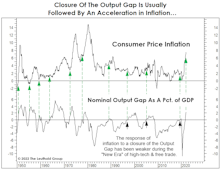

For months, we’ve argued there are two ways of thinking about the current economic cycle. Economist types are likely to side with their brethren at the NBER, who say the recovery has entered its 23rd month. But those observing the broad range of economic and financial gauges might view this cycle as a single economic expansion dating back to mid-2009.

Zigs And “Zags”

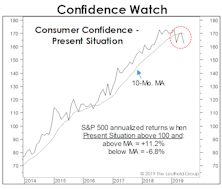

Like Gonzaga in the NCAA basketball tournament, stock market bulls are set for their first real test in a very long time.

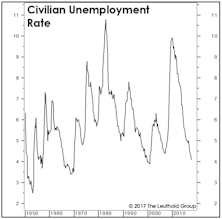

Is Powell A “Phillips Curve” Guy?

With consumer price inflation raging at 6.2% and few indications of an imminent rollover, Jay Powell has waved the white flag and retired the ill-begotten “transitory” descriptor. The timing of Powell’s concession is intriguing—perhaps he’s a fellow follower of a simple inflation model: the Output Gap.

Full Employment Brings Margin Risks

How high can corporate profit margins go? The third quarter saw a new record of 11.0% in NIPA “all economy” after-tax margins, and figures for the S&P 500, due out in a few weeks, will also set a record.

Time To Start Thinking About “Thinking About…”

The COVID collapse showed the Fed could abandon its clunky forward guidance and make the appropriate “pivot” when the facts changed. Now that facts have changed for the better, the Fed is right back to the rigid and dogmatic approach that characterized Fed-speak for almost all of the last economic expansion.

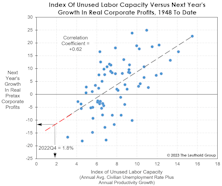

Are Earnings Set To “Gap” Higher?

We are troubled that the bullish optimism has spilled over into the 2020 estimates for S&P 500 earnings. Zero growth in 2020 is probably not a bad guess for NIPA figures, but S&P numbers don’t always follow suit.

Recession Evidence: How Much Is Enough?

Over a 12-month horizon, we now believe a U.S. recession is very likely, but aren’t confident enough to make the call when the forecast window is cut in half. Second-half stock returns could be decent if the business-cycle peak is still a year away. Then again, there’s peril in waiting for “too much” confirmation of recession.

Allocation Implications Of Full Employment

While the economy’s move above its full-employment level carries reliably negative implications for profit margins, the impact on equity returns has varied greatly from cycle to cycle.

Profits Have Peaked

With the S&P 500 EPS count steadily shrinking and managers getting ever more creative with “adjusted EPS,” corporate profits measured with standardized accounting rules merit a closer look.

An Economy This Healthy Is Hostile To Profits

It’s hard to grow profits when an economy’s resources are already fully employed, a fact we highlighted when the U.S. Output Gap turned positive several quarters ago. Therefore, the first quarter drop in NIPA corporate profits, reported yesterday, shouldn’t have come as a surprise.

Margins Prove Capitalism Still Works

Corporate profits were outstanding last year, but even the benefit of a 40% cut in the top income-tax rate wasn’t enough to lift the net profit margin back to the all-time high of 10.6% established in early 2012. Still, the latest 10.0% figure is more than a percentage point above the 2007 cycle high and about two points better than any other cycle high.

The Gap Is Back!

We celebrated the official closure of the GDP Output Gap in December, but that milestone was revised away in April by the statisticians at the CBO through a downward adjustment to the estimated rate of “full employment.”

The “Gap” Is Gone. Now What?

In Q3, the CBO’s Nominal Output Gap swung to positive for the first time since the last business cycle peak. This type of move has historically meant the cyclical peak in profit margins is close at hand.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)